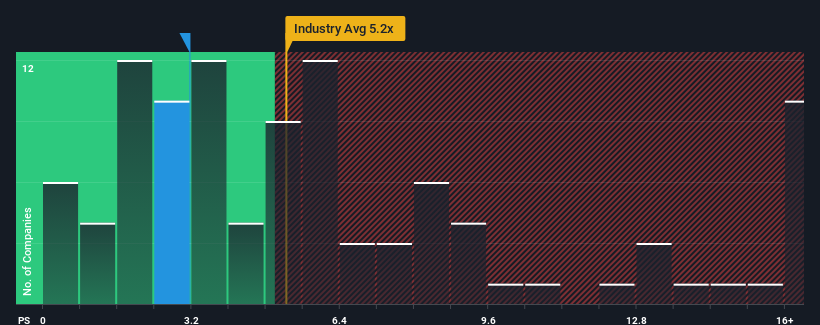

You may think that with a price-to-sales (or "P/S") ratio of 3.2x CICT Mobile Communication Technology Co., Ltd. (SHSE:688387) is a stock worth checking out, seeing as almost half of all the Communications companies in China have P/S ratios greater than 5.2x and even P/S higher than 9x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for CICT Mobile Communication Technology

How Has CICT Mobile Communication Technology Performed Recently?

Recent times have been pleasing for CICT Mobile Communication Technology as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CICT Mobile Communication Technology.How Is CICT Mobile Communication Technology's Revenue Growth Trending?

In order to justify its P/S ratio, CICT Mobile Communication Technology would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, CICT Mobile Communication Technology would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.5%. The latest three year period has also seen an excellent 73% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 31% as estimated by the lone analyst watching the company. With the industry predicted to deliver 43% growth, the company is positioned for a weaker revenue result.

With this information, we can see why CICT Mobile Communication Technology is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On CICT Mobile Communication Technology's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of CICT Mobile Communication Technology's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for CICT Mobile Communication Technology with six simple checks.

If these risks are making you reconsider your opinion on CICT Mobile Communication Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.