Oriental Selection requires Douyin's traffic, and Douyin requires Oriental Selection's unique tone in the cultural industry, expertise in “selecting good things”, and product resources.

Recently, Oriental Selection announced that it will officially launch cultural tourism products on December 10. Well-known anchors Dun Dun and Bei Bei will launch broadcasts in Sanya, Hainan, Lijiang, and Jilin on the “Oriental Selection App” and the Douyin “Oriental Selection Watch the World” account. Oriental Selection has officially joined the competition with Ctrip and Meituan wine travel products.

“This is the first time the company has listed cultural tourism products,” Dongfang Selection told Jianzhi Research. “More than 100 wine tourism companies have reached cooperation with them to launch cultural tourism products such as travel packages, attraction tickets, and hotels on the app.”

Oriental Selection's layout of the cultural tourism business has begun to take shape since last year. The live broadcast on location in July last year and the “Oriental Selection Watch the World” account was set up in December. They are all preparing for timely commercialization. It is only a matter of time before cultural tourism products are officially released. With the formal establishment of Oriental Selection (Zhuhai) Tourism and Culture Co., Ltd. in October this year, it also marks that the company has obtained relevant qualifications, and the time has come for commercialization.

Compared to Oriental Selection's launch of cultural tourism products, what shocked the market even more was the magical scene that happened during the Douyin “Oriental Selection Sees the World” live broadcast. The live broadcast room not only directly guides users to download the Oriental Selection App, but the anchor even teaches how to download and introduce self-employed members and their preferential policies on the spot.

This kind of diversion behavior was unimaginable on the Douyin platform in the past. “Downloading an app to open a membership is more discounted” is equivalent to stealing users directly from Douyin. Now that Oriental Selection has been able to draw so blatantly from Douyin to its own app, it is also speculated by the outside world that it has reached some kind of “strategic cooperation” with Douyin.

The delicate relationship between Oriental Selection and Douyin

Normally, e-commerce platforms such as Douyin strictly regulate external draining behavior. Irregularities usually lead to live streaming rooms being removed from the shelves or traffic restrictions. As a result, Oriental Selection did not often sit on a “cold bench.”

One iconic incident was that in July of this year, when the anchor of Oriental Selection explained the ingredient list, the self-operated store was directly removed from the shelves by Douyin because a QR code was displayed on the packaging.

This move has also accelerated Dongfang's selection of self-operated apps and entry into Taobao, seeking new additions other than Douyin. According to statistics from netizen Changgong Mu Xing Chen, FY2024H1 (corresponding to June to November 23 of the natural year), the company's Douyin platform, had about 4.902 billion yuan (down 2.8% year on year, down 3.3% month on month), Taobao 1,244 billion yuan, and app 541 million yuan.

Simply put, under Douyin's current limit, Oriental Selection has not grown on the Douyin platform; the increase has mainly come from Taobao and self-operated apps.

As a result, the “Oriental Selection Sees the World” account can be transferred to the self-operated app in a fair and honest way on the Douyin live broadcast, making one have to speculate that Oriental Selection has reached some kind of strategic cooperation with Douyin.

How much increase in performance can cultural tourism products bring to Oriental Selection?

Since it is a strategic cooperation, both sides naturally want to bring value of 1+1 greater than 2 through this kind of cooperation. Dongfang Selection requires traffic from Douyin, and Douyin also needs Oriental Selection's unique advantages in the cultural industry to compete with Meituan in stores.

Jianzhi Research has analyzed in various articles such as “Oriental Selection Uses 199 Yuan to “Bind” Fans” that the current business logic of Oriental Selection is no longer a live broadcast with goods, but rather to build an “online boutique supermarket.” Its self-operated products and fee-paying membership model are the core of its business.

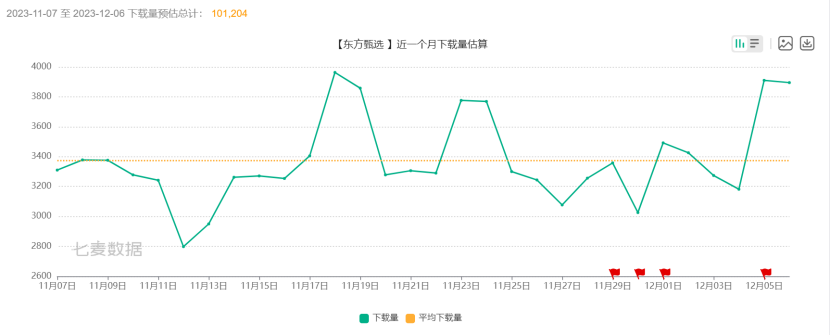

After cooperating with Douyin, the most direct benefit of Dongfang Selection was the introduction of Douyin's huge traffic into its own app. According to statistics from Qimai Data's iPhone, Dongfang Selection advertised on the Douyin live broadcast that day, and the number of app downloads increased rapidly, peaking for 2 consecutive days. The effectiveness of Douyin's traffic import has been verified to a certain extent, but how long it will last will also depend on the quality of cultural tourism products launched later and the level of user approval.

The selling point given by Dongfang's selection of cultural tourism products is “high quality and low price.” Jianzhi's research noticed that Dongfang selected the newly launched Lijiang Shangri-La 5-day, 4-night private group. The original price was set at 6,172 yuan/2 people, and the live streaming exclusive price was reduced to 4,280 yuan/2 people; Ctrip's own private group services on similar routes started at 3184/person. Both provide high value-added services that are different from regular tours, such as airport transfers, private car transfers, and 1V1 guides. However, there is a slight difference in accommodation standards. Oriental Choice offers 4 Diamond Hotels, while Ctrip offers 5 Diamond Hotels.

Despite some differences, Oriental Selection offers a more affordable price level compared to similar competitors, and the “low price promotion” is certainly not a false name.

This also serves its purpose: using travel route offers to leverage downloads. First, attract consumers through low prices, and channel them to their own apps. Using membership discounts to buy travel products with high unit prices is more cost-effective, which is conducive to the transformation of membership rates. After purchasing members, consumers will also be greedy for cheaper prices, forcing them to consume more of their own products.

Therefore, for the current stage of Oriental selection, seizing traffic at low prices is only the first step. The ultimate goal is to convert new users into paying members and achieve a closed loop of consumption of self-operated products driven by members' rights. Currently, it is still in the market cultivation period. The core is the accumulation of user size and word of mouth, not the maximization of short-term profits.

Oriental Selection needs to prove to the market that “selling culture” is not only about selling rice, but can also be used in tourism products.

Although the imagination is good, the following key factors still need to be considered about the impact of cultural tourism products after launch, and how much increase in performance they can actually bring to Oriental Selection:

First, the write-off rate in the cultural tourism products industry is generally low, usually around 10%. Cultural tourism products generally have a high unit price for customers, and those that buy products at will without cancellation are relatively small. The main reason for non-write-off is that the information is asymmetrical. Many cultural tourism products exaggerate their advantages during promotion, and there is a gap between actual experience and description, leading to user dissatisfaction and therefore refunds.

Although the cultural interpretation behind the attractions is a unique advantage of Oriental Selection from other competitors, the tour routes and actual user experience test Oriental Selection's ability to design cultural tourism products themselves. This is something that Oriental Selection has not covered in the past.

Second, it is still unclear how “self-operated” cultural tourism products are. How to cooperate with partners in all aspects of “pre-order placement - cancellation - travel process - after-sales”, down to customer service consultation before placing an order, car experience, guide expertise, and the company's ability to handle emergencies, etc., will directly affect consumption transformation and subsequent reputation.

Douyin adds another chip to the field of local life

For Douyin's side, the arrival of Oriental Selection has undoubtedly added chips to its in-store business. This year, the battle between Douyin and Meituan's local business has become the focus of the market. The core is how much of Meituan's in-store business can be stolen by Douyin.

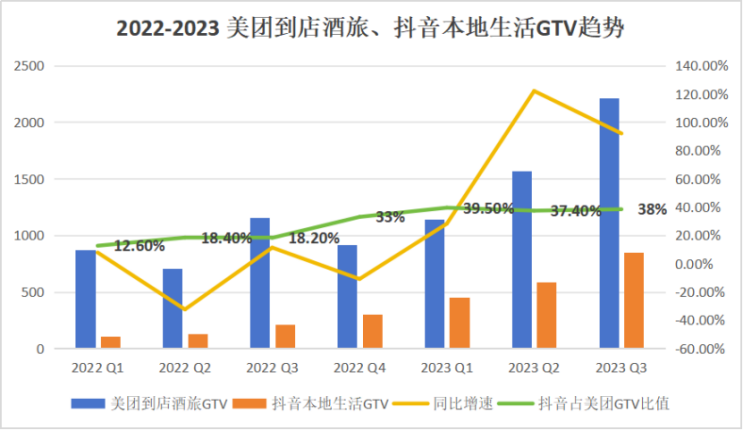

The development of Douyin's local business this year has indeed exceeded market expectations. Especially in the latter stages of the pandemic, it rapidly increased its market share through low-priced group purchase packages, and made great strides in the model of charging advertising fees based on lower commissions and traffic. Douyin once accounted for about 40% of Meituan's write-off amount (GTV) during the peak of the Spring Festival this year.

(Insightful research on homemade maps)

Looking at the breakdown, the in-store business is mainly divided into three categories: food delivery, integration, and wine travel. In Douyin's GTV structure, the meal delivery business dominates. This is because the food delivery business has the characteristics of high frequency, low decision costs, and low customer unit prices, making Douyin able to promote Douyin more efficiently.

However, when the business shifts to integrated wine tourism, where decision costs are higher, these fields are often accompanied by higher customer unit prices and higher product profit margins, yet it is not easy for consumers to impulsively place orders, but instead make choices after comparison and reading extensive reviews. This type of business is more suitable for platforms like Meituan, which has a strong search mentality and review resources.

(Meituan/Douyin ratio in the meal delivery business is the lowest)

But TikTok doesn't want to give up this piece of meat.

Currently, travel products on Douyin mainly rely on live streaming of a certain attraction, and there is a lack of influential sellers and professional travel route design, which limits the variety and quantity of travel products. Oriental Selection, on the other hand, distinguishes it from the unique advantages of other anchors in terms of cultural attributes, the professionalism of “selecting good things,” and the diverse cultural tourism products it provides, such as travel packages, attraction tickets, and hotel packages, just what Douyin needs.

The cooperation between the two may involve Douyin taking advantage of Oriental Selection's above advantages in the field of cultural tourism to attract and seize a portion of the user base first. The traffic was then expanded to other travel anchors to support the backbone and tail anchors.

Going one step further, it is not ruled out that Douyin will use Dongfang Selection as a similar outsourced team to jointly expand the wine travel business and share profits in a certain proportion.

summed

Generally speaking, Oriental Selection and Douyin are guided by the interests of both parties, from a “delicate relationship” to a “strategic cooperation.”

On the one hand, taking advantage of Douyin's massive traffic, Oriental Selection can rapidly expand the number of users of cultural tourism products, which in turn can be converted into paid members, counteracting consumption of self-operated products, and achieving the goal of closing the business loop;

On the other hand, the alcohol travel business with high customer unit prices and high gross margin will be Douyin's next driving force. Douyin needs Oriental's unique tone in the cultural industry, expertise in “selecting good things”, and product resources to quickly bridge the gap between this sector and Meituan. The two are typical of mutual benefit and win-win situation.

Ultimately, whether we can fulfill our wishes also depends on whether product design, user experience, etc. can withstand the test of the market and become a real “explosion.”