Penske Automotive Group Insiders Sell US$5.8m Of Stock, Possibly Signalling Caution

Penske Automotive Group Insiders Sell US$5.8m Of Stock, Possibly Signalling Caution

Over the past year, many Penske Automotive Group, Inc. (NYSE:PAG) insiders sold a significant stake in the company which may have piqued investors' interest. When evaluating insider transactions, knowing whether insiders are buying versus if they selling is usually more beneficial, as the latter can be open to many interpretations. However, if numerous insiders are selling, shareholders should investigate more.

在過去的一年中,許多彭斯克汽車集團有限公司(紐約證券交易所代碼:PAG)內部人士出售了該公司的大量股份,這可能激起了投資者的興趣。在評估內幕交易時,了解內部人士是買入還是賣出通常更有利,因爲後者可能有多種解釋。但是,如果有許多內部人士出售,股東應該進行更多調查。

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing.

儘管我們絕不會建議投資者僅根據公司董事的所作所爲做出決定,但我們確實認爲密切關注內部人士的所作所爲是完全合乎邏輯的。

View our latest analysis for Penske Automotive Group

查看我們對潘世奇汽車集團的最新分析

Penske Automotive Group Insider Transactions Over The Last Year

彭斯克汽車集團過去一年的內幕交易

Over the last year, we can see that the biggest insider sale was by the President & Director, Robert Kurnick, for US$1.8m worth of shares, at about US$166 per share. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. It's of some comfort that this sale was conducted at a price well above the current share price, which is US$150. So it may not tell us anything about how insiders feel about the current share price.

在過去的一年中,我們可以看到,最大的內幕交易是總裁兼董事羅伯特·庫爾尼克(Robert Kurnick)以價值180萬美元的股票出售,每股約166美元。儘管內幕拋售是負面的,但對我們來說,如果以較低的價格出售股票,則更爲負面。令人欣慰的是,此次出售的價格遠高於目前的股價,即150美元。因此,它可能無法告訴我們內部人士對當前股價的看法。

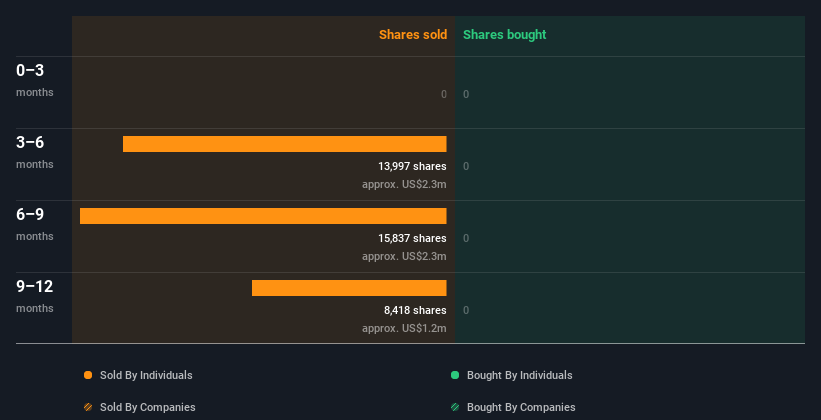

Insiders in Penske Automotive Group didn't buy any shares in the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

彭斯克汽車集團的內部人士去年沒有購買任何股票。您可以在下表中看到過去一年的內幕交易(由公司和個人進行的)。點擊下圖,你可以看到每筆內幕交易的確切細節!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

如果你像我一樣,那麼你不會想錯過這份業內人士正在收購的成長型公司的免費名單。

Insider Ownership

內部所有權

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Penske Automotive Group insiders own about US$220m worth of shares (which is 2.2% of the company). Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

對於普通股股東來說,值得檢查一下公司內部人士持有多少股票。通常,內部人所有權越高,內部人士被激勵長期建立公司的可能性就越大。彭斯克汽車集團內部人士擁有價值約2.2億美元的股份(佔該公司的2.2%)。大多數股東會樂於看到這種內幕所有權,因爲這表明管理層的激勵措施與其他股東非常一致。

So What Does This Data Suggest About Penske Automotive Group Insiders?

那麼,這些數據對彭斯克汽車集團內部人士有何啓示呢?

It doesn't really mean much that no insider has traded Penske Automotive Group shares in the last quarter. It's great to see high levels of insider ownership, but looking back over the last year, we don't gain confidence from the Penske Automotive Group insiders selling. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For example, Penske Automotive Group has 3 warning signs (and 1 which is concerning) we think you should know about.

上個季度沒有內部人士交易過彭斯克汽車集團的股票,這並不意味着什麼。很高興看到內幕所有權居高不下,但回顧去年,彭斯克汽車集團內部人士的拋售並未獲得信心。因此,這些內幕交易可以幫助我們建立有關該股的論點,但了解該公司面臨的風險也值得一試。例如,彭斯克汽車集團有3個警告標誌(其中一個令人擔憂),我們認爲你應該知道。

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

如果你想看看另一家公司——一家財務狀況可能優越的公司——那麼千萬不要錯過這份免費的股本回報率高、債務低的有趣公司的名單。

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

就本文而言,內部人士是那些向相關監管機構報告交易的個人。目前,我們僅對公開市場交易和直接利益的私人處置進行覈算,但不考慮衍生品交易或間接權益。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

Over the last year, we can see that the biggest insider sale was by the President & Director, Robert Kurnick, for US$1.8m worth of shares, at about US$166 per share. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. It's of some comfort that this sale was conducted at a price well above the current share price, which is US$150. So it may not tell us anything about how insiders feel about the current share price.

Over the last year, we can see that the biggest insider sale was by the President & Director, Robert Kurnick, for US$1.8m worth of shares, at about US$166 per share. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. It's of some comfort that this sale was conducted at a price well above the current share price, which is US$150. So it may not tell us anything about how insiders feel about the current share price.