Is MCN a good business model

In the end, the “Little Essay” ended up being “choose one of two,” and it was unexpected that this farce would fall into a situation like this.

In the end, the “Little Essay” ended up being “choose one of two,” and it was unexpected that this farce would fall into a situation like this.

When I read history books, I was amazed by the royal general's power and strategy. However, when the “hero of merit” in the book is placed in the workplace, you are puzzled: Why is this world like this?

Perhaps, this is the truth. The world has always operated this way, but we have forgotten it.

! 1

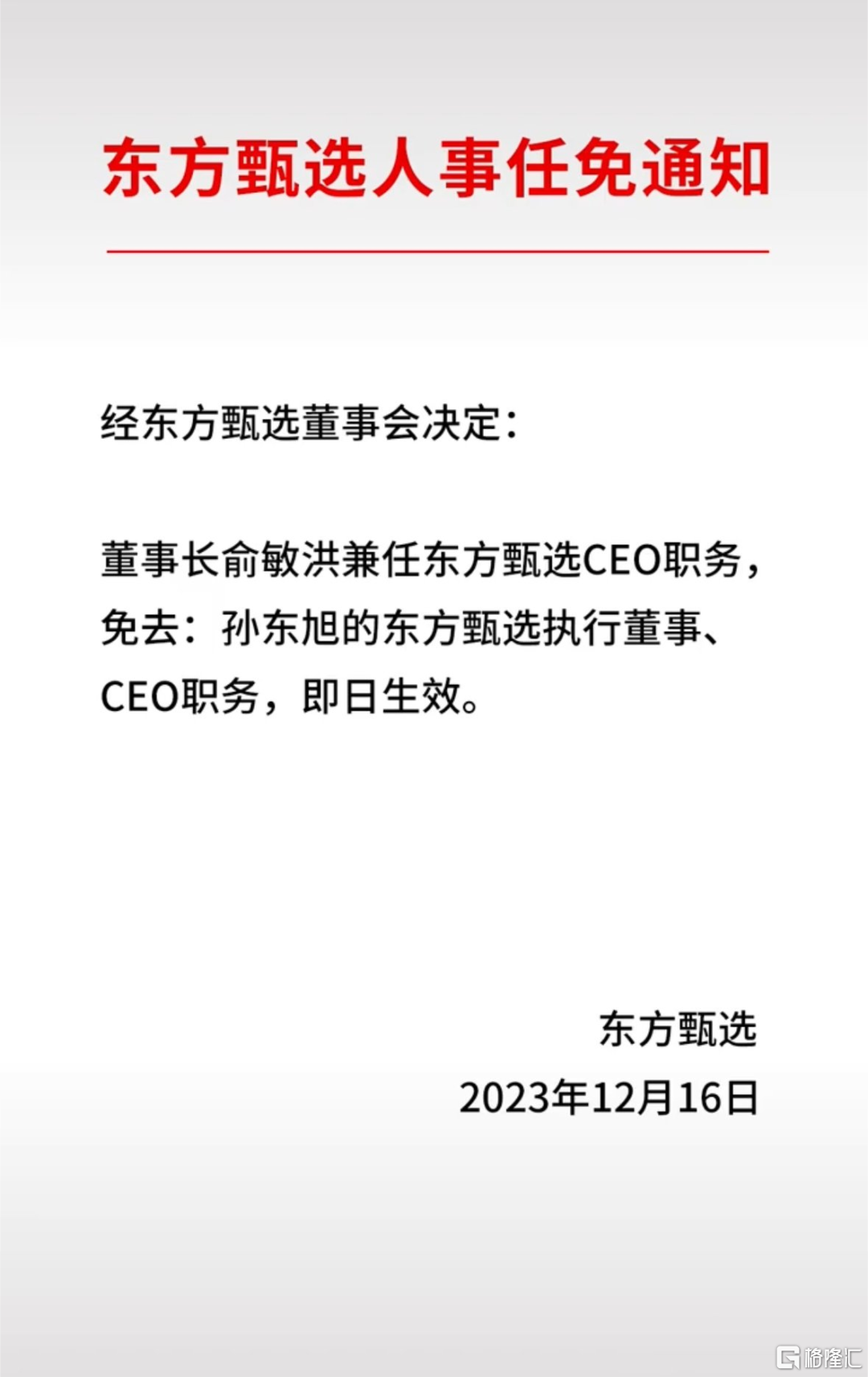

Sun Dongxu was removed from his position as CEO

Early this morning, Oriental Selection suddenly announced the cessation of broadcasting. Less than 12 hours later, Oriental Selection CEO Sun Dongxu announced that he has been removed from his position as CEO, with Chairman Yu Minhong serving concurrently.

Since this little essay storm broke out, everyone has been depending on how the Oriental selection will be carried out. Bao Dong Yuhui or Sun Dongxu? Yu Minhong's response on December 14 was actually to consider the overall situation and take care of everyone's feelings.

However, in reality, there is no way to allow the Oriental selection to hesitate any more.

From 31.16 million on December 9 to 28.44 million now, Dongfang Selected's Douyin account lost more than 2.7 million followers. Even after announcing the removal of the CEO, it continues to lose followers at a rate of 1,000 people per minute.

The performance of the secondary market is even more astonishing. From December 11 to December 15, Oriental Selection experienced a steady decline of 24%, and its market capitalization evaporated by more than HK$8 billion.

(The content of this article is a list of objective data and information and does not constitute any investment advice)

As the only education ETF in the entire market, pond fish were affected even more. On December 13, it was hit head-on by the three major scoundrels.

Because of education ETF holdings, the second-largest stock held by New Oriental-S, accounting for 14.42%, and the seventh-largest heavyweight stock, selected by Oriental, also accounted for 4.61% of the weight.

What's even more interesting is that after two days of falling education ETFs, there was money to buy against the trend. On December 13 and December 14, a total of 27 million education ETF shares were purchased.

(Schematic diagram of changes in education ETF shares)

This extravagant wealth just hit the competition.

From December 11 to 14, Gaotu US stocks have accumulated a cumulative increase of nearly 73%, hitting a new high since March this year. Gaotu Live fans from December 10 to 12, Gaotu Live increased 68,000 followers, fans exceeded 1 million, and average daily sales directly doubled 100 times.

If it gets messed up like this again, is it still there?

2

Is the MCN business model desirable?

When the time for the “small essay” came out, I wasn't convinced; wasn't it just a trivial matter? Is it worth making such a big fuss about going online?

It wasn't until I saw that big names such as Yi Zhongtian, Feng Tang, Fan Deng, and Ni Ping were hitting the sidelines from different angles when Dong Yuhui was already in the limelight, were they in a trance: where there are people, there are rivers, lakes, etc., the meaning of this sentence.

Indeed, once the “editor” of Dongfang's official account “Xiaobian” made inappropriate remarks, it's enough. How dare you criticize your own host again and again in front of the public?

What kind of thinking does the management have behind the editor of “Oriental Selection”?

Teacher Yu Minhong's “I Was Once on the Brink of Collapse” may be a glimpse of the tip of the iceberg. This book describes the path of entrepreneurship development in the New Oriental. Among them, an enterprise is highly dependent on one person. The book describes it like this:

If a company relies too much on a certain person in a certain field, such as technology, marketing, or product design, and no one else can do it, the result is either to give this person particularly high remuneration and equity incentives, or to find someone of a similar level to do this with him. Otherwise, to a certain extent, there will be a phenomenon of “running out” or “getting rich.”

The book also gives an example of “Why was the first teacher to 'rebel' a math logic teacher”. Because there was only one math logic teacher at the time, Yu Minhong, the manager, rejected the request when this teacher requested processing pay, because if one person was given processing pay, other teachers' wages would also rise, and employment costs would increase greatly.

The book's conclusion on this matter is:

When there's one thing you can't do, be sure to find a few people to help you do it at the same time. Unless you believe that you have given this person enough benefits, and these benefits guarantee that he will be willing to work with you for the rest of his life.

However, this set of weighted checks and balances management mentality is clearly not applicable to the era of the influencer economy. The influencer economy, to put it bluntly, is the fan economy. Fans recognize the people they like, not the institutions behind them.

But this also shows that MCN is not a sexy business model. Countless examples show that there is no way to copy top KOLs in batches. Even top influencers such as Li Jiaqi, Via, and Simba are not able to train big anchors who can compete with them on their own. Didn't Dongfang select only a phenomenal influencer like Dong Yuhui?

Luo Yonghao, who has eaten all of the e-commerce live streaming dividends, knows this very well. He has long said: Remember Dong Yuhui's name, not Dongfang's selection. 80% of value is created by 20% of people.

Therefore, on December 15, there was also a report that the relevant person in charge of Oriental Selection said they also vowed that adhering to the product line in the influencer model and product line is the best choice for Oriental Selection to respond to questions.

What about reality? In just one day, the CEO was ousted, so there's no need to say anything more.

3

The Securities Regulatory Commission loosens the repurchase of listed companies

On December 15, the Securities Regulatory Commission issued the “Listed Company Supervision Guidelines No. 3 - Cash Dividends for Listed Companies” (hereinafter referred to as the “Cash Dividend Guidelines”) and the “Decision on Amending the 'Guidelines on the Articles of Association of Listed Companies'” (hereinafter referred to as the “Articles of Association Guidelines”), which took effect from the date of publication. At the same time, the Securities Regulatory Commission also revised and issued the “Rules on Repurchase of Shares of Listed Companies” (hereinafter referred to as the “Repurchase Rules” for short), optimizing and improving some provisions.

There are three main aspects of the revised content of the “Cash Dividend Guidelines”: one is to further clarify and encourage the orientation of cash dividends and promote an increase in the level of dividends; the second is to simplify the medium-term dividend procedure and promote further optimization of dividend methods and pace. The third is to tighten restrictions on enterprises with abnormally high dividend ratios to guide reasonable dividends.

The main contents of this revision of the “Repurchase Rules” include: first, focusing on improving the convenience of share repurchases, relaxing and adding a condition for repurchasing shares necessary to protect the company's value and shareholders' rights, abolishing the rule prohibiting the repurchase window period, moderately relaxing the basic repurchase conditions for listed companies, and optimizing the prohibitions on reporting repurchase transactions.

Second, further improve the repurchase restraint mechanism, encourage listed companies to form institutional arrangements to implement repurchases, and clearly address the board's obligations in repurchase situations necessary to protect the company's value and shareholders' rights. In particular, it was mentioned to strictly prevent “foolish repurchases” and add the provision that “stock exchanges may adopt self-regulatory measures or impose disciplinary sanctions in accordance with business rules.”

It is worth mentioning that the exchange is methodically launching various indices on dividends and repurchases to guide more long-term capital into the market and invest in high-quality listed companies with high dividends and more repurchases

On October 17, the first batch of indices focusing on share repurchases released by the Shanghai Stock Exchange and the China Securities Company was officially launched. The four indices are the Shanghai Composite Repurchase Index, the China Securities Repurchase Index, the China Securities Repurchase Value Strategy Index, and the China Securities Repurchase Quality Strategy Index.

On November 28, the Shenzhen Stock Exchange released the Shenzhen Stock Exchange Dividend 300 Index and the Shenzhen Stock Exchange Repurchase Index, which aim to further highlight active cash dividends and active stock repurchase companies, guide the high-quality development of listed companies, help build the investment side of the capital market, and better serve medium- to long-term capital allocation needs.