Some Hoe Leong Corporation Ltd. (SGX:H20) Shareholders Look For Exit As Shares Take 67% Pounding

Some Hoe Leong Corporation Ltd. (SGX:H20) Shareholders Look For Exit As Shares Take 67% Pounding

Hoe Leong Corporation Ltd. (SGX:H20) shares have had a horrible month, losing 67% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 50% share price decline.

和隆有限公司(新加坡证券交易所股票代码:H20)的股价经历了糟糕的一个月,在经历了相对较好的时期之后下跌了67%。对于任何长期股东来说,最后一个月的股价下跌幅度为50%,这将是一年的最后一个月。

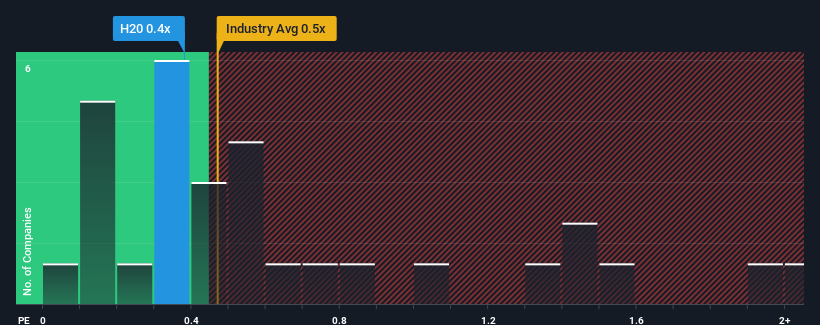

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Hoe Leong's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in Singapore is also close to 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

即使在价格大幅下跌之后,你对Hoe Leong的0.4倍市盈率漠不关心还是可以原谅的,因为新加坡机械行业的市盈率(或 “市盈率”)中位数也接近0.5倍。尽管这可能不会引起任何关注,但如果市盈率不合理,投资者可能会错过潜在的机会或忽视迫在眉睫的失望。

View our latest analysis for Hoe Leong

查看我们对Hoe Leong的最新分析

SGX:H20 Price to Sales Ratio vs Industry December 18th 2023

2023 年 12 月 18 日,新加坡证券交易所:H20 市售比率与行业对比

How Has Hoe Leong Performed Recently?

Hoe Leong 最近表现如何?

For example, consider that Hoe Leong's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

例如,考虑一下,由于收入下降,Hoe Leong最近的财务表现不佳。一种可能性是,市盈率适中,因为投资者认为该公司在不久的将来仍可能做得足以与整个行业保持一致。如果你喜欢这家公司,你至少希望情况如此,这样你就有可能在它不太受青睐的情况下买入一些股票。

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hoe Leong's earnings, revenue and cash flow.

我们没有分析师的预测,但您可以查看我们关于Hoe Leong收益、收入和现金流的免费报告,了解最近的趋势如何为公司未来奠定基础。

How Is Hoe Leong's Revenue Growth Trending?

Hoe Leong 的收入增长趋势如何?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hoe Leong's to be considered reasonable.

有一种固有的假设是,一家公司应该与行业相提并论,这样像Hoe Leong这样的市盈率才算合理。

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 4.5% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

回顾过去,去年该公司的收入下降了12%,令人沮丧。这意味着从长远来看,它的收入也有所下滑,因为在过去三年中,总收入下降了4.5%。因此,不幸的是,我们必须承认,在此期间,该公司在增加收入方面做得并不出色。

In contrast to the company, the rest of the industry is expected to grow by 36% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

与该公司形成鲜明对比的是,该行业的其他部门预计将在明年增长36%,这确实可以预见该公司最近的中期收入下降。

In light of this, it's somewhat alarming that Hoe Leong's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

有鉴于此,Hoe Leong的市盈率与大多数其他公司的市盈率持平,这有点令人震惊。看来大多数投资者都忽视了最近糟糕的增长率,他们希望公司的业务前景出现转机。只有最大胆的人才会认为这些价格是可持续的,因为最近的收入趋势的持续最终可能会打压股价。

The Bottom Line On Hoe Leong's P/S

Hoe Leong P/S 的底线

Hoe Leong's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Hoe Leong的股价暴跌使其市盈率回到了与该行业其他公司相似的区域。仅使用市售比率来确定是否应该出售股票是不明智的,但是它可以作为公司未来前景的实用指南。

We find it unexpected that Hoe Leong trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

我们感到意想不到的是,尽管中期收入下降,但Hoe Leong的市盈率仍与行业其他部门相当,而整个行业预计将增长。在行业预测不断增长的背景下,当我们看到收入倒退时,预计股价可能下跌,从而使温和的市盈率下降是有道理的。除非最近的中期情况有所改善,否则预计公司股东将面临艰难时期是没有错的。

We don't want to rain on the parade too much, but we did also find 5 warning signs for Hoe Leong (1 is potentially serious!) that you need to be mindful of.

我们不想在游行队伍中下太多雨,但我们也发现了 Hoe Leong 的 5 个警告标志(1 个可能很严重!)你需要注意的。

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

如果过去盈利增长稳健的公司处于困境,那么你可能希望看到这些盈利增长强劲、市盈率低的其他公司的免费集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。

SGX:H20 Price to Sales Ratio vs Industry December 18th 2023

SGX:H20 Price to Sales Ratio vs Industry December 18th 2023