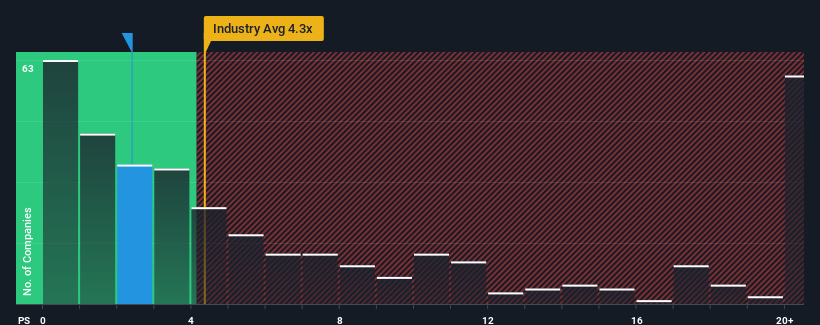

There wouldn't be many who think Lakala Payment Co., Ltd.'s (SZSE:300773) price-to-sales (or "P/S") ratio of 2.4x is worth a mention when the median P/S for the Diversified Financial industry in China is very similar. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Lakala Payment

How Has Lakala Payment Performed Recently?

Recent times haven't been great for Lakala Payment as its revenue has been falling quicker than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. You'd much rather the company improve its revenue if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Lakala Payment's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Lakala Payment?

In order to justify its P/S ratio, Lakala Payment would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, Lakala Payment would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.9%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 33% as estimated by the four analysts watching the company. With the rest of the industry predicted to shrink by 8.7%, that would be a fantastic result.

With this information, we find it odd that Lakala Payment is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Bottom Line On Lakala Payment's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We note that even though Lakala Payment trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Lakala Payment with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.