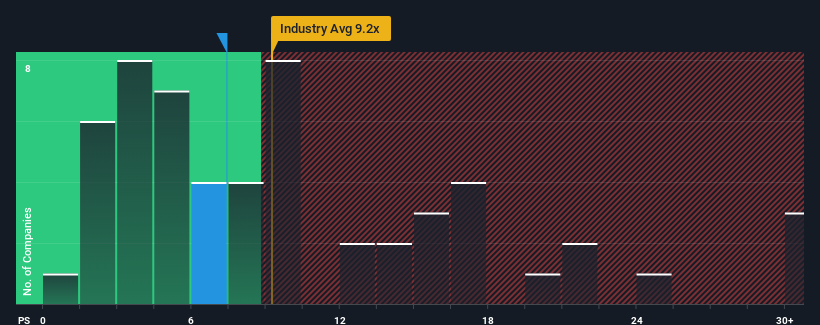

It's not a stretch to say that Hangzhou Shunwang Technology Co,Ltd's (SZSE:300113) price-to-sales (or "P/S") ratio of 7.4x right now seems quite "middle-of-the-road" for companies in the Entertainment industry in China, where the median P/S ratio is around 9.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Hangzhou Shunwang Technology CoLtd

What Does Hangzhou Shunwang Technology CoLtd's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Hangzhou Shunwang Technology CoLtd has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Hangzhou Shunwang Technology CoLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hangzhou Shunwang Technology CoLtd's to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hangzhou Shunwang Technology CoLtd's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 29% last year. Revenue has also lifted 22% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 20% over the next year. That's shaping up to be materially lower than the 35% growth forecast for the broader industry.

In light of this, it's curious that Hangzhou Shunwang Technology CoLtd's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Hangzhou Shunwang Technology CoLtd's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that Hangzhou Shunwang Technology CoLtd's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Hangzhou Shunwang Technology CoLtd you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.