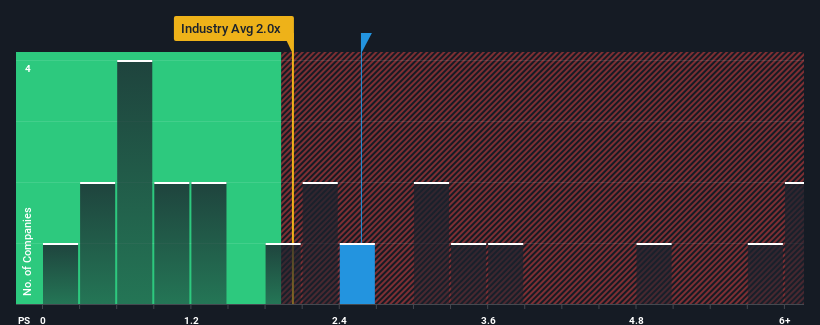

When close to half the companies in the Auto industry in China have price-to-sales ratios (or "P/S") below 2x, you may consider BAIC BluePark New Energy Technology Co.,Ltd. (SHSE:600733) as a stock to potentially avoid with its 2.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for BAIC BluePark New Energy TechnologyLtd

What Does BAIC BluePark New Energy TechnologyLtd's P/S Mean For Shareholders?

Recent times have been advantageous for BAIC BluePark New Energy TechnologyLtd as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think BAIC BluePark New Energy TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is BAIC BluePark New Energy TechnologyLtd's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like BAIC BluePark New Energy TechnologyLtd's to be considered reasonable.

There's an inherent assumption that a company should outperform the industry for P/S ratios like BAIC BluePark New Energy TechnologyLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 58%. The latest three year period has also seen an excellent 37% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 46% as estimated by the only analyst watching the company. That's shaping up to be similar to the 49% growth forecast for the broader industry.

With this information, we find it interesting that BAIC BluePark New Energy TechnologyLtd is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does BAIC BluePark New Energy TechnologyLtd's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given BAIC BluePark New Energy TechnologyLtd's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about these 4 warning signs we've spotted with BAIC BluePark New Energy TechnologyLtd (including 2 which can't be ignored).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.