China Ocean Group Development Limited (HKG:8047) shareholders are no doubt pleased to see that the share price has bounced 32% in the last month, although it is still struggling to make up recently lost ground. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

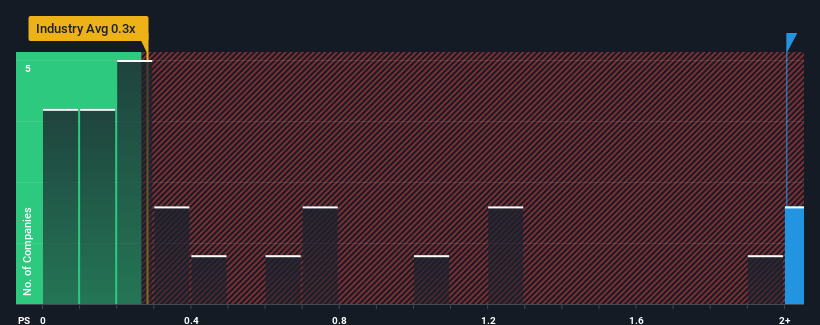

After such a large jump in price, when almost half of the companies in Hong Kong's Logistics industry have price-to-sales ratios (or "P/S") below 0.3x, you may consider China Ocean Group Development as a stock probably not worth researching with its 2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for China Ocean Group Development

What Does China Ocean Group Development's P/S Mean For Shareholders?

China Ocean Group Development has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

China Ocean Group Development has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Is There Enough Revenue Growth Forecasted For China Ocean Group Development?

There's an inherent assumption that a company should outperform the industry for P/S ratios like China Ocean Group Development's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 65% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 6.1% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that China Ocean Group Development is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does China Ocean Group Development's P/S Mean For Investors?

China Ocean Group Development shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of China Ocean Group Development revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 4 warning signs for China Ocean Group Development (2 make us uncomfortable!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.