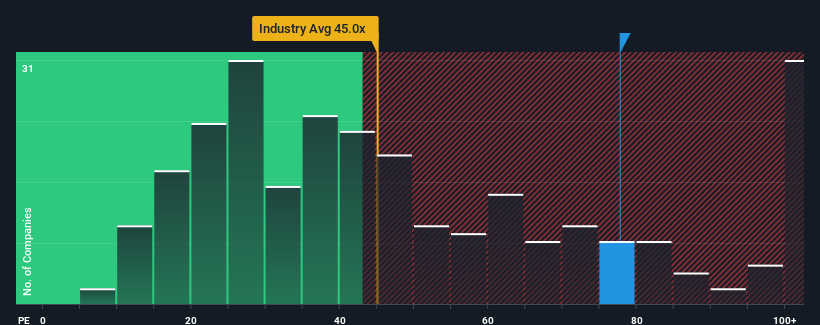

When close to half the companies in China have price-to-earnings ratios (or "P/E's") below 34x, you may consider Hangzhou Jizhi Mechatronic Co., Ltd. (SZSE:300553) as a stock to avoid entirely with its 77.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Hangzhou Jizhi Mechatronic certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Hangzhou Jizhi Mechatronic

How Is Hangzhou Jizhi Mechatronic's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Hangzhou Jizhi Mechatronic's to be considered reasonable.

There's an inherent assumption that a company should far outperform the market for P/E ratios like Hangzhou Jizhi Mechatronic's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 87%. Pleasingly, EPS has also lifted 113% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 44% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Hangzhou Jizhi Mechatronic is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Hangzhou Jizhi Mechatronic's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Hangzhou Jizhi Mechatronic currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Hangzhou Jizhi Mechatronic you should be aware of.

If you're unsure about the strength of Hangzhou Jizhi Mechatronic's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.