Marcus & Millichap, Inc. (NYSE:MMI) shares have continued their recent momentum with a 27% gain in the last month alone. Looking further back, the 21% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

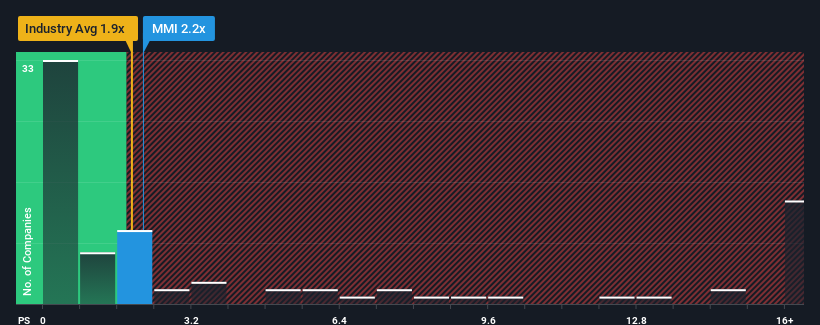

Even after such a large jump in price, there still wouldn't be many who think Marcus & Millichap's price-to-sales (or "P/S") ratio of 2.2x is worth a mention when the median P/S in the United States' Real Estate industry is similar at about 1.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Marcus & Millichap

How Marcus & Millichap Has Been Performing

While the industry has experienced revenue growth lately, Marcus & Millichap's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

While the industry has experienced revenue growth lately, Marcus & Millichap's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

How Is Marcus & Millichap's Revenue Growth Trending?

Marcus & Millichap's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 52%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 5.3% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 12% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 10.0%, which is not materially different.

With this in mind, it makes sense that Marcus & Millichap's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Its shares have lifted substantially and now Marcus & Millichap's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A Marcus & Millichap's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Real Estate industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Before you take the next step, you should know about the 2 warning signs for Marcus & Millichap (1 shouldn't be ignored!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.