Shanghai Fudan Microelectronics Group Company Limited (HKG:1385) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

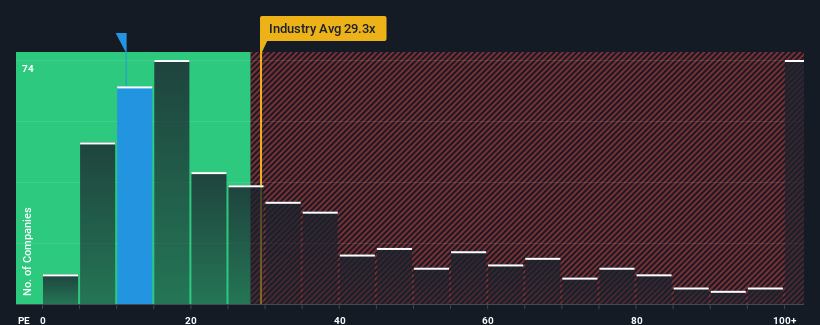

Although its price has dipped substantially, Shanghai Fudan Microelectronics Group may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 11.1x, since almost half of all companies in Hong Kong have P/E ratios under 8x and even P/E's lower than 4x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Shanghai Fudan Microelectronics Group as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Shanghai Fudan Microelectronics Group

View our latest analysis for Shanghai Fudan Microelectronics Group

What Are Growth Metrics Telling Us About The High P/E?

Shanghai Fudan Microelectronics Group's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's bottom line. Even so, admirably EPS has lifted 914% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 24% during the coming year according to the two analysts following the company. Meanwhile, the rest of the market is forecast to expand by 23%, which is not materially different.

In light of this, it's curious that Shanghai Fudan Microelectronics Group's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

Shanghai Fudan Microelectronics Group's P/E hasn't come down all the way after its stock plunged. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Shanghai Fudan Microelectronics Group's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Shanghai Fudan Microelectronics Group has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Shanghai Fudan Microelectronics Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.