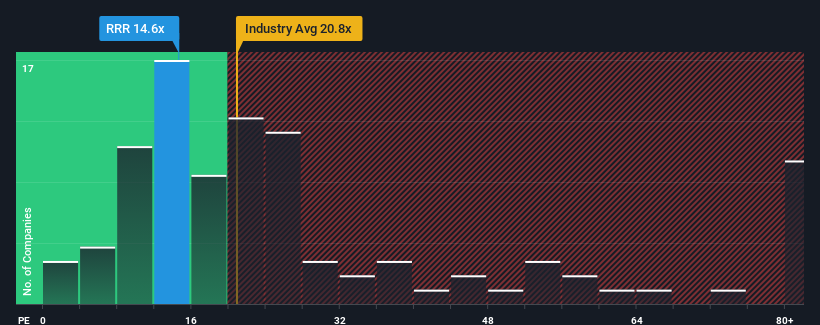

Red Rock Resorts, Inc.'s (NASDAQ:RRR) price-to-earnings (or "P/E") ratio of 14.6x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 17x and even P/E's above 33x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Red Rock Resorts has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Red Rock Resorts

Is There Any Growth For Red Rock Resorts?

In order to justify its P/E ratio, Red Rock Resorts would need to produce sluggish growth that's trailing the market.

In order to justify its P/E ratio, Red Rock Resorts would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 15%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings growth is heading into negative territory, declining 43% over the next year. With the market predicted to deliver 10% growth , that's a disappointing outcome.

In light of this, it's understandable that Red Rock Resorts' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Red Rock Resorts maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 4 warning signs for Red Rock Resorts (2 are a bit unpleasant!) that you need to take into consideration.

Of course, you might also be able to find a better stock than Red Rock Resorts. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.