- 投資產品

- 交易功能

- 市場分析

- 費用和利率

- 優惠活動

- 資源

- 幫助中心

- 關於我們

- 關於moomoo

- 品牌動態

- Moomoo 桌面端

- Moomoo 基金會

- 紅人計劃

- 投資者關係您即將從moomoo.com跳轉至富途控股官方網站。

- English

- 中文繁體

- 中文简体

- 深色

- 淺色

- 要聞

- 蘇州納微科技有限公司's (SHSE: 688690) 價格與收入一致

Suzhou Nanomicro Technology Co., Ltd.'s (SHSE:688690) Price In Tune With Revenues

Suzhou Nanomicro Technology Co., Ltd.'s (SHSE:688690) Price In Tune With Revenues

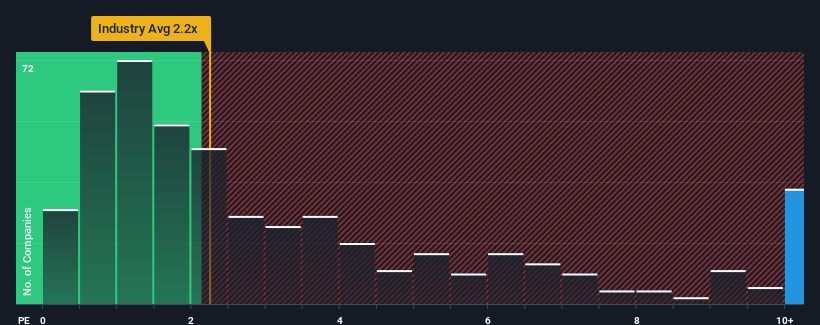

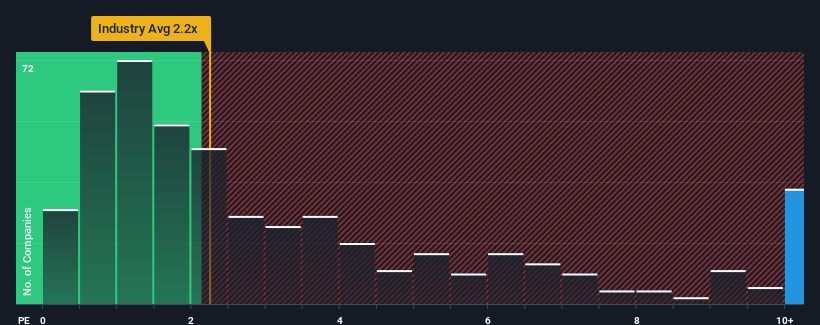

When close to half the companies in the Chemicals industry in China have price-to-sales ratios (or "P/S") below 2.2x, you may consider Suzhou Nanomicro Technology Co., Ltd. (SHSE:688690) as a stock to avoid entirely with its 15.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Suzhou Nanomicro Technology

What Does Suzhou Nanomicro Technology's Recent Performance Look Like?

Suzhou Nanomicro Technology certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Suzhou Nanomicro Technology will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Suzhou Nanomicro Technology would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Suzhou Nanomicro Technology would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.3%. The latest three year period has also seen an excellent 235% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 48% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 30%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Suzhou Nanomicro Technology's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Suzhou Nanomicro Technology shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Suzhou Nanomicro Technology that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

當中國近一半的化工行業公司的市銷比(或 “市盈率”)低於2.2倍時,你可以考慮將蘇州納微科技股份有限公司(SHSE: 688690)作爲股票,以其15.4倍的市盈率完全避免。儘管如此,我們需要更深入地挖掘,以確定市盈率大幅上升是否有合理的基礎。

查看我們對蘇州納微科技的最新分析

蘇州納微科技最近的表現如何?

蘇州納微科技最近確實做得很好,因爲它的收入增長幅度超過了大多數其他公司。市盈率可能很高,因爲投資者認爲這種強勁的收入表現將繼續下去。你真的希望如此,否則你會無緣無故地付出相當大的代價。

想全面了解分析師對公司的估計嗎?那麼我們關於蘇州納微科技的免費報告將幫助您發現即將發生的事情。收入增長指標告訴我們高市盈率有哪些?

爲了證明其市盈率是合理的,蘇州納微科技需要實現遠遠超過該行業的出色增長。

爲了證明其市盈率是合理的,蘇州納微科技需要實現遠遠超過該行業的出色增長。

如果我們回顧一下去年的收入增長,該公司公佈了8.3%的可觀增長。在最近三年中,總收入也實現了235%的出色增長,這在一定程度上得益於其短期表現。因此,股東們肯定會對這些中期收入增長率表示歡迎。

關注該公司的兩位分析師表示,展望未來,預計來年收入將增長48%。同時,預計該行業的其餘部分將僅增長30%,其吸引力明顯降低。

考慮到這一點,不難理解爲什麼蘇州納微科技的市盈率高於同行。顯然,股東們並不熱衷於轉移可能着眼於更繁榮未來的東西。

關鍵要點

通常,我們傾向於限制使用價格與銷售比率來確定市場對公司整體健康狀況的看法。

我們對蘇州納微科技的調查表明,由於其未來收入強勁,其市盈率仍然很高。看來股東對公司的未來收入充滿信心,這支撐了市盈率。在這種情況下,很難看到股價在不久的將來會強勁下跌。

別忘了可能還有其他風險。例如,我們已經確定了蘇州納微科技的1個警告信號,你應該注意這一點。

重要的是要確保你尋找一家優秀的公司,而不僅僅是你遇到的第一個想法。因此,如果盈利能力的增長與你對一家優秀公司的想法一致,那就來看看這份免費名單吧,列出了最近收益增長強勁(市盈率低)的有趣公司。

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧