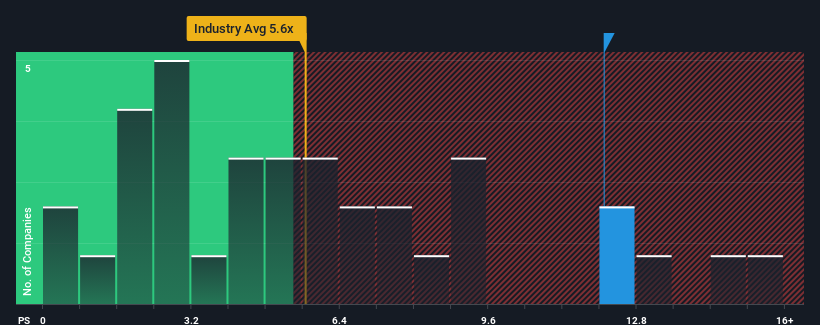

When close to half the companies in the Hospitality industry in China have price-to-sales ratios (or "P/S") below 5.6x, you may consider Caissa Tosun Development Co.,Ltd. (SZSE:000796) as a stock to avoid entirely with its 12.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Caissa Tosun DevelopmentLtd

How Has Caissa Tosun DevelopmentLtd Performed Recently?

With revenue growth that's inferior to most other companies of late, Caissa Tosun DevelopmentLtd has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Caissa Tosun DevelopmentLtd.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Caissa Tosun DevelopmentLtd's is when the company's growth is on track to outshine the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as steep as Caissa Tosun DevelopmentLtd's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 79% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 411% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 37%, which is noticeably less attractive.

In light of this, it's understandable that Caissa Tosun DevelopmentLtd's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Caissa Tosun DevelopmentLtd shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Caissa Tosun DevelopmentLtd has 3 warning signs (and 2 which make us uncomfortable) we think you should know about.

If these risks are making you reconsider your opinion on Caissa Tosun DevelopmentLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.