Top Energy Company Ltd.Shanxi (SHSE:600780) shares have had a horrible month, losing 25% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 32%, which is great even in a bull market.

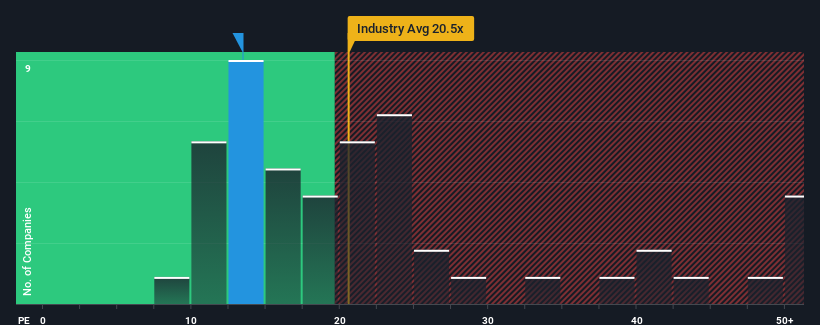

Since its price has dipped substantially, Top Energy CompanyShanxi may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 13.4x, since almost half of all companies in China have P/E ratios greater than 35x and even P/E's higher than 64x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For instance, Top Energy CompanyShanxi's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Top Energy CompanyShanxi

See our latest analysis for Top Energy CompanyShanxi

How Is Top Energy CompanyShanxi's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Top Energy CompanyShanxi's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 222% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 44% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

In light of this, it's peculiar that Top Energy CompanyShanxi's P/E sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What We Can Learn From Top Energy CompanyShanxi's P/E?

Having almost fallen off a cliff, Top Energy CompanyShanxi's share price has pulled its P/E way down as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Top Energy CompanyShanxi currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching the company's performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Top Energy CompanyShanxi with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.