To the annoyance of some shareholders, Jiumaojiu International Holdings Limited (HKG:9922) shares are down a considerable 28% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 71% loss during that time.

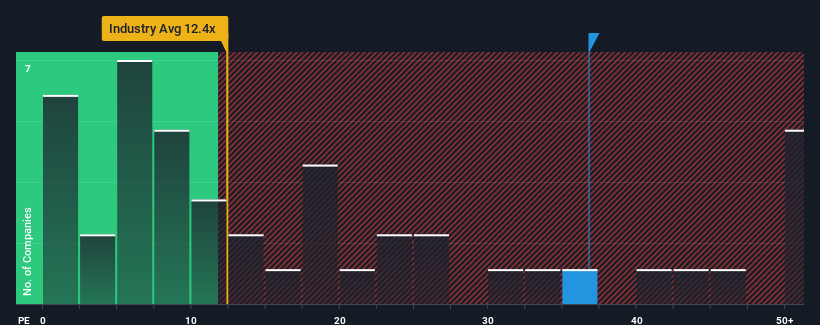

Even after such a large drop in price, Jiumaojiu International Holdings' price-to-earnings (or "P/E") ratio of 36.8x might still make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 8x and even P/E's below 4x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Jiumaojiu International Holdings as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Jiumaojiu International Holdings

How Is Jiumaojiu International Holdings' Growth Trending?

Jiumaojiu International Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 80% per year over the next three years. That's shaping up to be materially higher than the 16% per year growth forecast for the broader market.

With this information, we can see why Jiumaojiu International Holdings is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Jiumaojiu International Holdings' shares may have retreated, but its P/E is still flying high. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Jiumaojiu International Holdings maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Jiumaojiu International Holdings with six simple checks on some of these key factors.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.