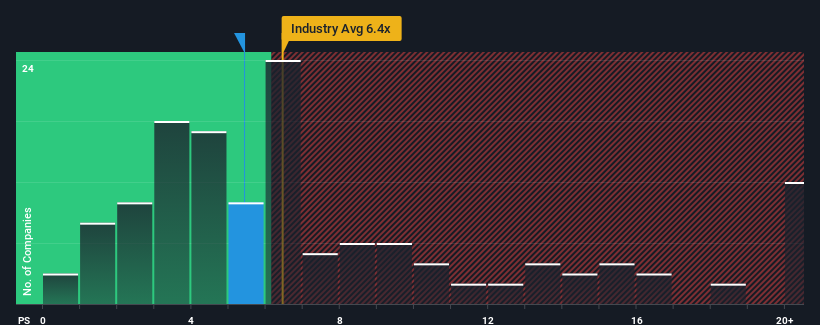

It's not a stretch to say that Client Service International, Inc.'s (SZSE:300663) price-to-sales (or "P/S") ratio of 5.4x right now seems quite "middle-of-the-road" for companies in the Software industry in China, where the median P/S ratio is around 6.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Client Service International

How Has Client Service International Performed Recently?

Client Service International could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Client Service International.How Is Client Service International's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Client Service International's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Client Service International's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.8%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 13% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 48% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 36%, which is noticeably less attractive.

With this information, we find it interesting that Client Service International is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Client Service International's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Client Service International's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 3 warning signs for Client Service International (1 is a bit unpleasant!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.