Troy Information Technology Co., Ltd. (SZSE:300366) shares have had a horrible month, losing 29% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 26%, which is great even in a bull market.

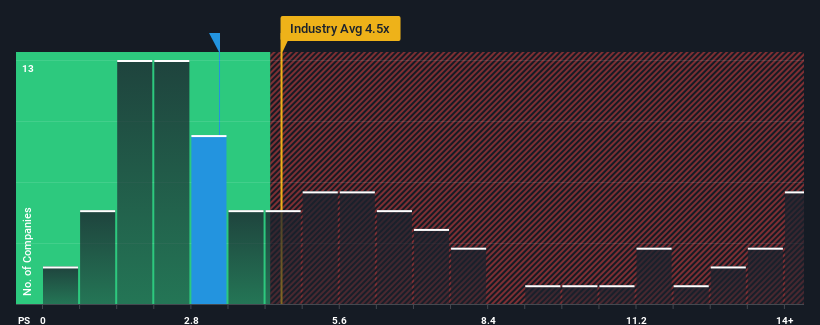

Since its price has dipped substantially, Troy Information Technology may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 3.3x, considering almost half of all companies in the IT industry in China have P/S ratios greater than 4.5x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Troy Information Technology

How Troy Information Technology Has Been Performing

With revenue growth that's superior to most other companies of late, Troy Information Technology has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

With revenue growth that's superior to most other companies of late, Troy Information Technology has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

How Is Troy Information Technology's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Troy Information Technology's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 35% last year. Still, revenue has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 31% as estimated by the lone analyst watching the company. With the industry predicted to deliver 49% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Troy Information Technology's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Troy Information Technology's P/S

Troy Information Technology's recently weak share price has pulled its P/S back below other IT companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Troy Information Technology's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware Troy Information Technology is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Troy Information Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.