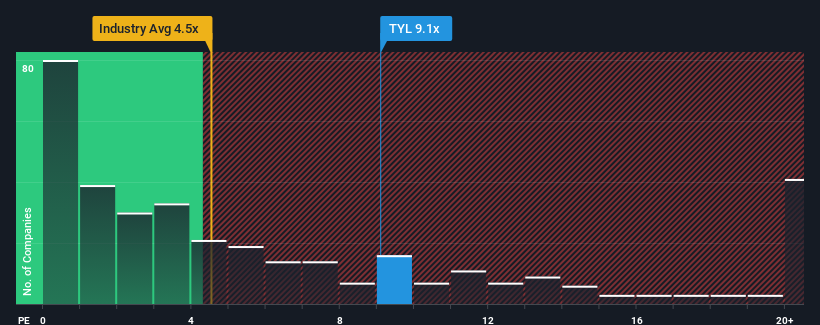

With a price-to-sales (or "P/S") ratio of 9.1x Tyler Technologies, Inc. (NYSE:TYL) may be sending very bearish signals at the moment, given that almost half of all the Software companies in the United States have P/S ratios under 4.5x and even P/S lower than 1.8x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Tyler Technologies

How Has Tyler Technologies Performed Recently?

Tyler Technologies could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Tyler Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Tyler Technologies' to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Tyler Technologies' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.0% last year. The latest three year period has also seen an excellent 71% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 8.3% per year during the coming three years according to the analysts following the company. With the industry predicted to deliver 17% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Tyler Technologies' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Tyler Technologies' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Tyler Technologies, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Tyler Technologies you should know about.

If these risks are making you reconsider your opinion on Tyler Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.