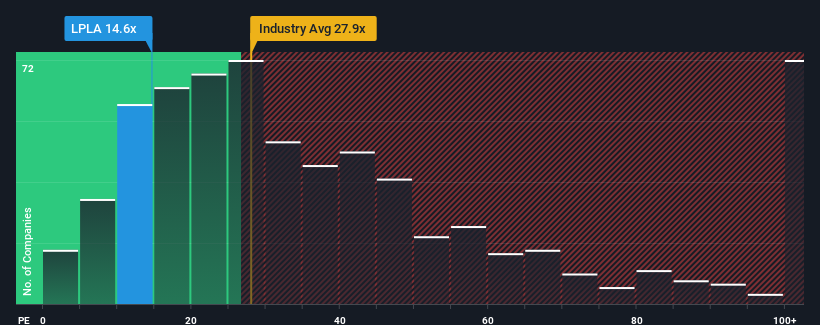

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider LPL Financial Holdings Inc. (NASDAQ:LPLA) as an attractive investment with its 14.6x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

LPL Financial Holdings certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for LPL Financial Holdings

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like LPL Financial Holdings' to be considered reasonable.

There's an inherent assumption that a company should underperform the market for P/E ratios like LPL Financial Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 89% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 152% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 11% per year over the next three years. With the market predicted to deliver 13% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that LPL Financial Holdings' P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On LPL Financial Holdings' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that LPL Financial Holdings currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for LPL Financial Holdings that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.