Mongolian Mining Corporation (HKG:975) Stocks Shoot Up 73% But Its P/S Still Looks Reasonable

Mongolian Mining Corporation (HKG:975) Stocks Shoot Up 73% But Its P/S Still Looks Reasonable

Despite an already strong run, Mongolian Mining Corporation (HKG:975) shares have been powering on, with a gain of 73% in the last thirty days. The last month tops off a massive increase of 272% in the last year.

尽管已经表现强劲,但蒙古矿业公司(HKG: 975)的股价一直在上涨,在过去的三十天中上涨了73%。上个月,去年大幅增长了272%。

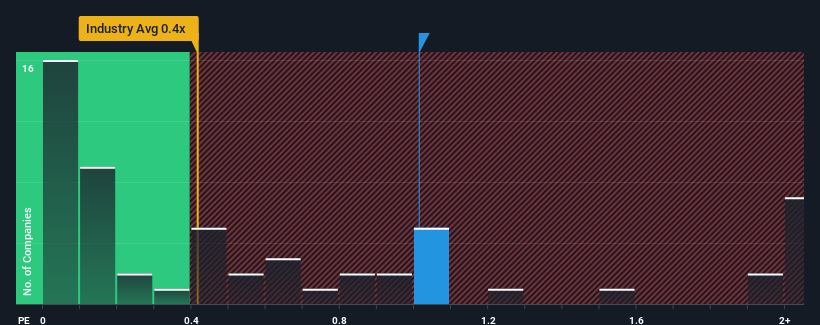

Since its price has surged higher, when almost half of the companies in Hong Kong's Metals and Mining industry have price-to-sales ratios (or "P/S") below 0.4x, you may consider Mongolian Mining as a stock probably not worth researching with its 1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

由于蒙古矿业的价格飙升,当香港金属和采矿业中将近一半的公司的市售率(或 “市盈率”)低于0.4倍时,你可以将蒙古矿业视为一只市盈率为1倍的股票可能不值得研究。但是,仅按面值计算市盈率是不明智的,因为可以解释为什么市盈率如此之高。

See our latest analysis for Mongolian Mining

查看我们对蒙古矿业的最新分析

SEHK:975 Price to Sales Ratio vs Industry December 25th 2023

香港交易所:975 市售比率与行业对比 2023 年 12 月 25 日

How Mongolian Mining Has Been Performing

蒙古矿业的表现如何

With revenue growth that's exceedingly strong of late, Mongolian Mining has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

蒙古矿业最近收入增长异常强劲,一直表现良好。看来许多人预计,强劲的收入表现将在未来一段时间内击败大多数其他公司,这增加了投资者购买该股的意愿。如果不是,那么现有股东可能会对股价的可行性感到有些紧张。

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Mongolian Mining's earnings, revenue and cash flow.

我们没有分析师的预测,但您可以查看我们关于蒙古矿业收益、收入和现金流的免费报告,了解最近的趋势如何为公司未来奠定基础。

What Are Revenue Growth Metrics Telling Us About The High P/S?

收入增长指标告诉我们高市盈率有哪些?

The only time you'd be truly comfortable seeing a P/S as high as Mongolian Mining's is when the company's growth is on track to outshine the industry.

看到像蒙古矿业一样高的市盈率只有当公司的增长有望超越该行业时,你才能真正感到自在。

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The latest three year period has also seen an excellent 109% overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

首先回顾一下,我们发现该公司的收入在过去的12个月中经历了猛烈的增长。在令人难以置信的短期表现的推动下,最近三年的总体收入也实现了109%的出色增长。因此,可以公平地说,该公司最近的收入增长非常好。

When compared to the industry's one-year growth forecast of 10%, the most recent medium-term revenue trajectory is noticeably more alluring

与该行业预测的10%一年增长相比,最新的中期收入轨迹明显更具吸引力

In light of this, it's understandable that Mongolian Mining's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

有鉴于此,可以理解蒙古矿业的市盈率高于大多数其他公司。据推测,股东们并不热衷于抛售他们认为将继续超越整个行业的东西。

What We Can Learn From Mongolian Mining's P/S?

我们可以从蒙古矿业的市盈率中学到什么?

The large bounce in Mongolian Mining's shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

蒙古矿业股价的大幅反弹极大地提高了该公司的市盈率。有人认为,在某些行业中,价格与销售比率是衡量价值的次要指标,但它可能是一个有力的商业情绪指标。

As we suspected, our examination of Mongolian Mining revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

正如我们所怀疑的那样,我们对蒙古矿业的审查显示,其三年收入趋势是其高市盈率的原因,因为这些趋势看起来好于当前的行业预期。在股东眼中,持续增长轨迹的可能性足以防止市盈率回落。除非公司的赚钱能力发生任何重大变化,否则股价应继续得到支撑。

We don't want to rain on the parade too much, but we did also find 1 warning sign for Mongolian Mining that you need to be mindful of.

我们不想在游行队伍中下太多雨,但我们还发现了一个需要注意的蒙古矿业警告信号。

If these risks are making you reconsider your opinion on Mongolian Mining, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果这些风险使您重新考虑对蒙古矿业的看法,请浏览我们的高质量股票互动清单,以了解还有什么。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接联系我们。或者,也可以发送电子邮件至编辑团队 (at) simplywallst.com。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

SEHK:975 Price to Sales Ratio vs Industry December 25th 2023

SEHK:975 Price to Sales Ratio vs Industry December 25th 2023