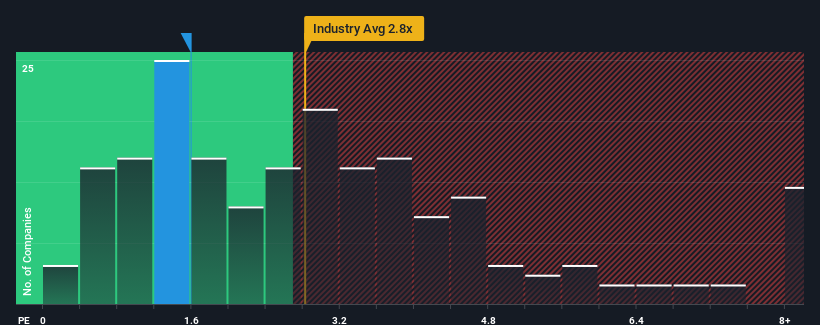

You may think that with a price-to-sales (or "P/S") ratio of 1.6x Aotecar New Energy Technology Co., Ltd. (SZSE:002239) is a stock worth checking out, seeing as almost half of all the Auto Components companies in China have P/S ratios greater than 2.8x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Aotecar New Energy Technology

How Aotecar New Energy Technology Has Been Performing

The revenue growth achieved at Aotecar New Energy Technology over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Aotecar New Energy Technology will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Aotecar New Energy Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Aotecar New Energy Technology's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. Pleasingly, revenue has also lifted 102% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 27% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that Aotecar New Energy Technology is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What Does Aotecar New Energy Technology's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Aotecar New Energy Technology currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Aotecar New Energy Technology that you should be aware of.

If these risks are making you reconsider your opinion on Aotecar New Energy Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.