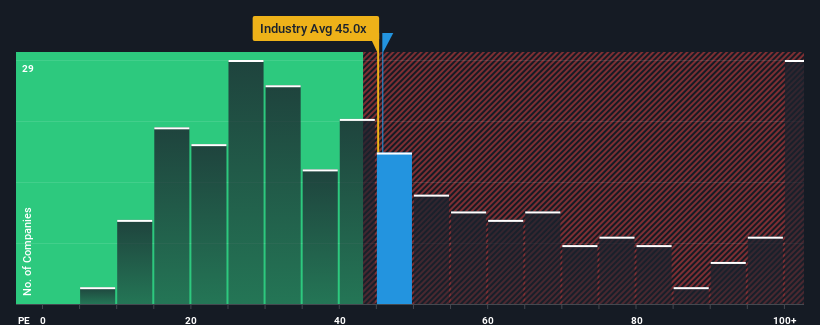

With a price-to-earnings (or "P/E") ratio of 45.7x TCL Technology Group Corporation (SZSE:000100) may be sending bearish signals at the moment, given that almost half of all companies in China have P/E ratios under 34x and even P/E's lower than 20x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With its earnings growth in positive territory compared to the declining earnings of most other companies, TCL Technology Group has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for TCL Technology Group

How Is TCL Technology Group's Growth Trending?

TCL Technology Group's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

TCL Technology Group's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 13%. However, this wasn't enough as the latest three year period has seen an unpleasant 40% overall drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 327% over the next year. With the market only predicted to deliver 44%, the company is positioned for a stronger earnings result.

With this information, we can see why TCL Technology Group is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that TCL Technology Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with TCL Technology Group (including 1 which makes us a bit uncomfortable).

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.