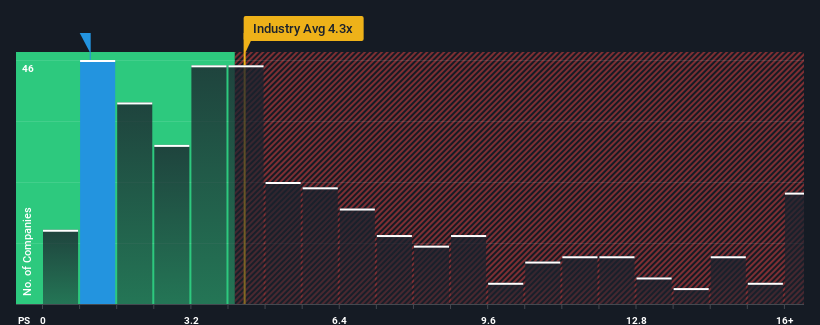

LianChuang Electronic Technology Co.,Ltd's (SZSE:002036) price-to-sales (or "P/S") ratio of 1x might make it look like a strong buy right now compared to the Electronic industry in China, where around half of the companies have P/S ratios above 4.3x and even P/S above 9x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for LianChuang Electronic TechnologyLtd

How LianChuang Electronic TechnologyLtd Has Been Performing

LianChuang Electronic TechnologyLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LianChuang Electronic TechnologyLtd.How Is LianChuang Electronic TechnologyLtd's Revenue Growth Trending?

LianChuang Electronic TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

LianChuang Electronic TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 35% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 19% as estimated by the nine analysts watching the company. With the industry predicted to deliver 62% growth, the company is positioned for a weaker revenue result.

With this information, we can see why LianChuang Electronic TechnologyLtd is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From LianChuang Electronic TechnologyLtd's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of LianChuang Electronic TechnologyLtd's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for LianChuang Electronic TechnologyLtd (2 make us uncomfortable) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.