Continental Aerospace Technologies Holding Limited (HKG:232) shares have had a really impressive month, gaining 25% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.7% in the last twelve months.

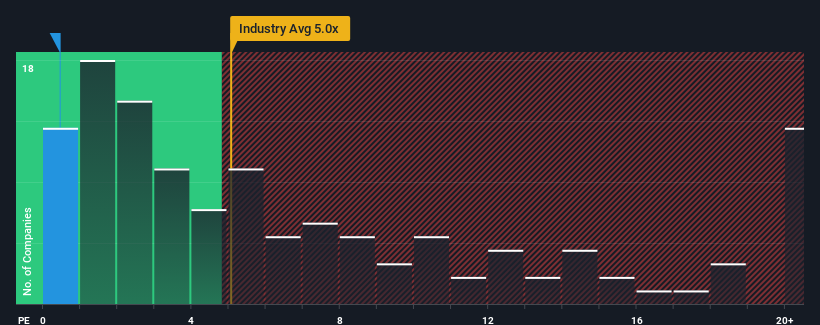

Although its price has surged higher, Continental Aerospace Technologies Holding may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Aerospace & Defense industry in Hong Kong have P/S ratios greater than 5x and even P/S higher than 11x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Continental Aerospace Technologies Holding

What Does Continental Aerospace Technologies Holding's Recent Performance Look Like?

Revenue has risen firmly for Continental Aerospace Technologies Holding recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on Continental Aerospace Technologies Holding will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Revenue has risen firmly for Continental Aerospace Technologies Holding recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on Continental Aerospace Technologies Holding will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Do Revenue Forecasts Match The Low P/S Ratio?

Continental Aerospace Technologies Holding's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. The solid recent performance means it was also able to grow revenue by 29% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 36% shows it's noticeably less attractive.

With this information, we can see why Continental Aerospace Technologies Holding is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Continental Aerospace Technologies Holding's P/S

Continental Aerospace Technologies Holding's recent share price jump still sees fails to bring its P/S alongside the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Continental Aerospace Technologies Holding revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Continental Aerospace Technologies Holding that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.