格隆匯12月27日丨昨晚晚,中國基金業協會公佈了最新公募基金市場數據。截至今年11月底,國內公募基金的最新總規模達到27.45萬億元,較10月增加711.75億元,結束此前連續3個月的下跌。公募基金的總份額達到26.20萬億份,基金數量爲1.14萬隻。

11月公募基金規模增長主要來自債券型基金、QDII基金,兩類基金單月規模分別增加2038億元、204億元。此外,股票型基金也因股票ETF逆勢獲得淨申購,實現規模增長。

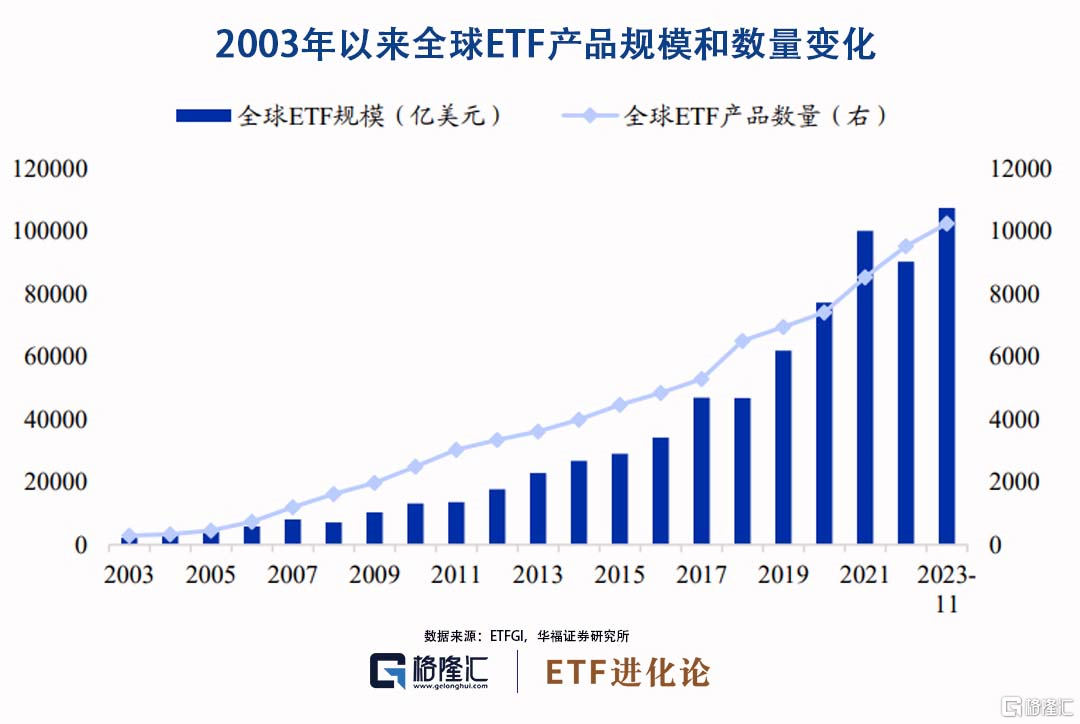

今年是ETF發展大年,2023年全球ETF市場規模再創新高。

根據華福證券統計,近20年來全球ETF產品規模穩步增長。2003年底全球ETF規模僅爲2120億美元,此後一路發展,並在2009年首次突破1萬億美元、在2021年又突破10萬億元大關,規模僅在2008年全球金融危機和2022年出現縮水,根據2023年11月底最新數據,全球ETF規模已達10.7萬億美元,相比去年年底增長7.6%。從產品數量上看,過去二十年ETF產品數量逐年增加,且2020年來增速加快,截至2023年11月底全球掛牌交易的ETF共有10251只,全年共新增724只。

根據華福證券統計,近20年來全球ETF產品規模穩步增長。2003年底全球ETF規模僅爲2120億美元,此後一路發展,並在2009年首次突破1萬億美元、在2021年又突破10萬億元大關,規模僅在2008年全球金融危機和2022年出現縮水,根據2023年11月底最新數據,全球ETF規模已達10.7萬億美元,相比去年年底增長7.6%。從產品數量上看,過去二十年ETF產品數量逐年增加,且2020年來增速加快,截至2023年11月底全球掛牌交易的ETF共有10251只,全年共新增724只。

從地區分佈看,美國是全球最主要的ETF市場,份額佔比達七成左右,其它主要市場包括歐洲(15.2%)、日本(4.7%)等。從資金流動看,截至今年11月底,全球ETF產品資金累計淨流入8031億美元,同比小幅上升2.1%,淨流入規模同樣處於歷史較高位。

美國佔據全球ETF市場主導地位,歐洲、日本佔比次之。截至2023年11月底,美國ETF規模約75170億美元,佔比約70%,其次歐洲ETF規模約16350億美元,佔比15.2%,剩餘的主要市場包括日本、亞太等地區。2023年全球ETF資金淨流入規模處於歷史較高位,其中股票型ETF資金流入大幅居前。

根據ETFGI數據,2023年1-11月全球ETF產品資金淨流入8031億美元,同比小幅上升2.1%,淨流入額爲歷史上第二高,僅次於2021年同期的1.1萬億。從各類產品資金流入份額看,股票ETF淨流入3974億美元,佔比49.5%,金額較去年下滑-10.6%,債券ETF淨流入2500億美元,佔比31.1%,淨流入金額較去年上升近15%,商品ETF淨流出-141億美元,和去年持平。

值得注意的是,12月以來A股投資者繼續買入ETF。截至12月26日,全市場826只股票ETF總管理規模爲1.65萬億元。12月以來,資金借道股票ETF淨流入約爲917億元,上證50、滬深300指數是資金流入主方向。

根据华福证券统计,近20年来全球ETF产品规模稳步增长。

根据华福证券统计,近20年来全球ETF产品规模稳步增长。