12月以来,资金借道股票ETF净流入约为917亿元,上证50、沪深300指数是资金流入主方向。

距离2023年收官仅有2个交易日,沪深300指数连跌3年,2021年以来跌超36%。上证指数在这个月接连打响3000点、2900点保卫战。

站在当下时点,信心比黄金更珍贵。

1

1

917亿!资金逆势抄底ETF

截至12月26日,2023年以来清盘基金数量达到了256只,创2019年以来新高。

今年以来股票型基金清盘数量达61只,为公募基金业1998年以来最高纪录;FOF基金清盘数量突破两位数,达到了12只,猛增至2022年的三倍,其中有7只为养老FOF产品。

一边是基金清盘数量创阶段新高,一边是ETF市场得到资金青睐。

12月26日晚,中国基金业协会公布了最新公募基金市场数据。截至今年11月底,国内公募基金的最新总规模达到27.45万亿元,较10月增加711.75亿元,结束此前连续3个月的下跌。公募基金的总份额达到26.20万亿份,基金数量为1.14万只。

11月公募基金规模增长主要来自债券型基金、QDII基金,两类基金单月规模分别增加2038亿元、204亿元。此外,股票型基金也因股票ETF逆势获得净申购,实现规模增长。

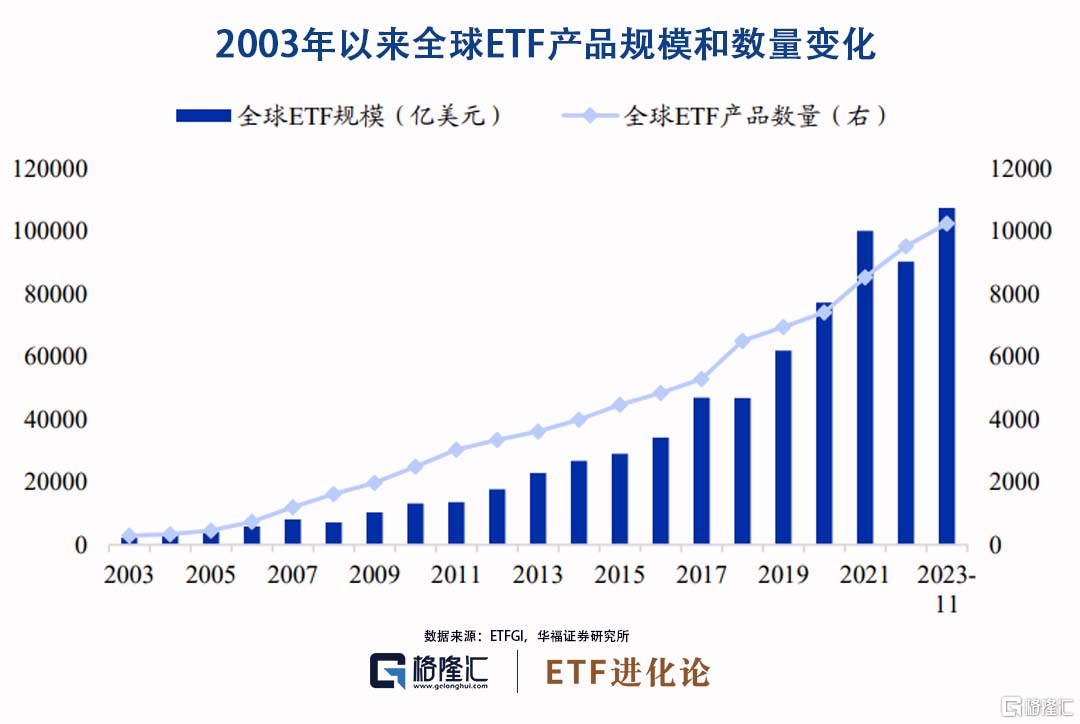

今年是ETF发展大年,2023年全球ETF市场规模再创新高。

根据华福证券统计,近20年来全球ETF产品规模稳步增长,截至2023年11月底,全球挂牌交易的ETF规模达10.7万亿美元,相比去年年底增长7.6%,再度创下历史新高。

从地区分布看,美国是全球最主要的ETF市场,份额占比达七成左右,其它主要市场包括欧洲(15.2%)、日本(4.7%)等。从资金流动看,截至今年11月底,全球ETF产品资金累计净流入8031亿美元,同比小幅上升2.1%,净流入规模同样处于历史较高位。

值得注意的是,12月以来A股投资者继续买入ETF。

截至12月26日,全市场826只股票ETF总管理规模为1.65万亿元。12月以来,资金借道股票ETF净流入约为917亿元,上证50、沪深300指数是资金流入主方向。

A股调整了三年,近10年走长牛的美股也曾经历过至暗时刻。

2008年金融危机,全球股市暴跌,美股标普500从2007年10月的高点开始调整,一直跌到2009年3月,期间的最大跌幅超过55%,而纳斯达克指数的最大跌幅甚至超过了70%。

当时市场已经处在极度恐慌状态下,伯克希尔的市值都缩水115亿美元。一片恐慌声中,2008年10月16日,巴菲特亲自在《纽约时报》发表文章《Buy American. I AM.》,发出了最坚定的声音,巴菲特写道:

“我要澄清一点,我无法预计股市的短期变动,对于股票1个月或1年内的涨跌情况我不敢妄言。然而有个情况很可能会出现,在市场恢复信心或经济复苏前,股市会上涨而且可能是大涨。因此,如果你等到知更鸟叫时,你将错过整个春天。”

2

美股还有5.88万亿美元的场外资金?

标普500指数连续8周上涨,但VIX指数(恐慌指数)有抬头上升之势,更有神秘资金在此位置大力押注。

在持续强劲上涨中空头被消灭后,市场开始产生分歧,神秘资金正押注VIX指数大反弹。近日出现一笔大规模期权交易,一名交易员押下巨额赌注,押注VIX指数将在1月17日从现在的13回到17。

近日知名投资机构Mott Capital Management创始人Michael J. Kramer发文表示,以上这些趋势可能意味着,最近整个美股市场和基准股指标普500指数大反弹阶段已接近或暂时结束,标普500指数甚至有可能回调至10月底开始反弹的启动水平,反弹之势可能将消退。

不过也有机构表示,明年美股还有巨额场外资金。

Fundstrat的技术策略师马克·牛顿在报告中表示,美国货币市场基金中不断增长的现金储备,应该会在2024年成为股市的有力支撑。

马克·牛顿认为,5%无风险利率使得今年货币市场基金资产激增,场外现金总额达到创纪录的5.88万亿美元,比去年增加了24%。“如果美联储明年开始降息,货币市场基金的无风险利率也将下降,将促使更多资金转向股市”。

该策略师认为,鉴于全球流动性背景和大量场外现金,未来几周或几个月的小幅回调应被视为买入机会。他说,一旦基金明年开始配置现金,这将进一步推动市场反弹。

马克·牛顿强调,不断增长的现金储备表明,尽管指数创下新高,但投资者对股市的乐观情绪并不像看上去那样充满泡沫。

3

时隔一年多,木头姐再次瞄准日股。

美股网红基金经理木头姐最近动作频频。

数据显示,木头姐旗下ARKF ETF今年以来的涨幅已接近94%,而纳斯达克100指数今年迄今上涨超53%。

(本文内容均为客观数据信息罗列,不构成任何投资建议)

(本文内容均为客观数据信息罗列,不构成任何投资建议)

当地时间12月26日,据彭博社报道,号称“华尔街女巴菲特”的凯茜·伍德管理的ARK Fintech Innovation ETF(ARKF)基金,上周买入日本科技巨头LY的股票,这是1年多以来的首次买入。在此之前,截至9月份的前4个季度中,木头姐旗下ETF基金一直在减持LY公司。

LY公司是通讯软件LINE和“雅虎日本”的运营商,该公司的多数股权由软银和韩国Naver公司的合资企业持有。LINE是日本知名的移动通讯程序,被称为“日本版微信”;雅虎日本(Yahoo! JAPAN)则是日本主要的搜索引擎之一。

今年4月以来,巴菲特旗下的伯克希尔·哈撒韦公司大举增持日本五大商社的股票,带动了外国投资者购买日本股票的势头。

据东京证券交易所统计数据显示,截至11月份,海外投资者今年仅有三个月是日股的净卖家,其他八个月均呈现了资金流入。

外资的流入,使得日股相关指数在年内双双触及33年高位,年内两大日本基准股指均上涨逾20%。A股市场,跟踪日股相关指数今年也获得不错的涨幅。