Kymera Therapeutics, Inc. (NASDAQ:KYMR) shares have continued their recent momentum with a 35% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 9.6% isn't as attractive.

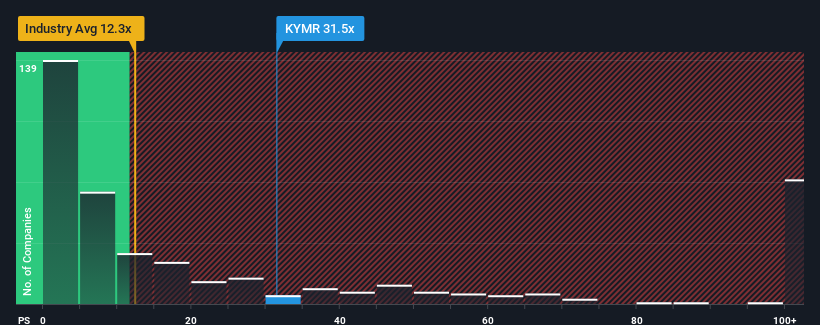

After such a large jump in price, Kymera Therapeutics may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 31.5x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios under 12.3x and even P/S lower than 3x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Kymera Therapeutics

What Does Kymera Therapeutics' P/S Mean For Shareholders?

Recent times haven't been great for Kymera Therapeutics as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Recent times haven't been great for Kymera Therapeutics as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Is There Enough Revenue Growth Forecasted For Kymera Therapeutics?

The only time you'd be truly comfortable seeing a P/S as steep as Kymera Therapeutics' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 103% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Turning to the outlook, the next three years should generate growth of 12% each year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 240% each year growth forecast for the broader industry.

In light of this, it's alarming that Kymera Therapeutics' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Kymera Therapeutics' P/S?

The strong share price surge has lead to Kymera Therapeutics' P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that Kymera Therapeutics currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You need to take note of risks, for example - Kymera Therapeutics has 3 warning signs (and 1 which is concerning) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.