Despite an already strong run, TPG Inc. (NASDAQ:TPG) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 56% in the last year.

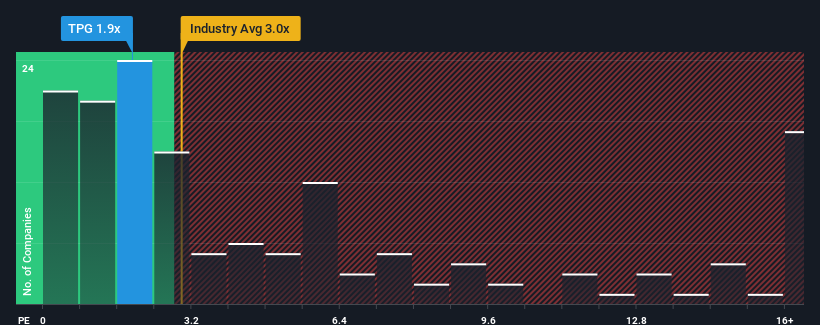

Even after such a large jump in price, TPG's price-to-sales (or "P/S") ratio of 1.9x might still make it look like a buy right now compared to the Capital Markets industry in the United States, where around half of the companies have P/S ratios above 3x and even P/S above 8x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for TPG

How Has TPG Performed Recently?

TPG could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

TPG could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Is There Any Revenue Growth Forecasted For TPG?

In order to justify its P/S ratio, TPG would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 30%. This means it has also seen a slide in revenue over the longer-term as revenue is down 13% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 6.6% each year during the coming three years according to the eight analysts following the company. That's shaping up to be similar to the 5.9% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that TPG's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does TPG's P/S Mean For Investors?

The latest share price surge wasn't enough to lift TPG's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that TPG currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for TPG that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.