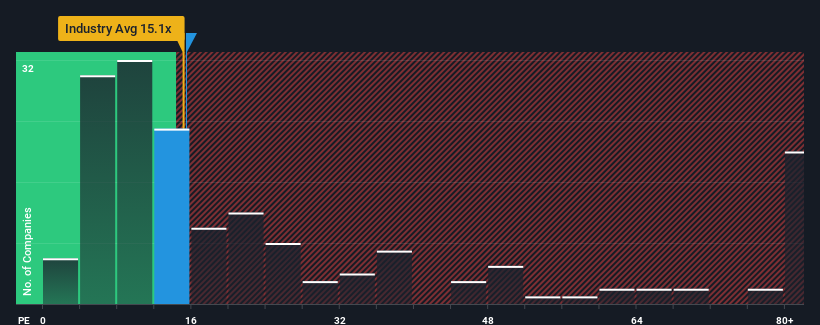

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may consider Anhui Xinhua Media Co., Ltd. (SHSE:601801) as a highly attractive investment with its 15.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for Anhui Xinhua Media as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Anhui Xinhua Media

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Anhui Xinhua Media's is when the company's growth is on track to lag the market decidedly.

The only time you'd be truly comfortable seeing a P/E as depressed as Anhui Xinhua Media's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 21%. The latest three year period has also seen an excellent 43% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 29% as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 44%, which is noticeably more attractive.

In light of this, it's understandable that Anhui Xinhua Media's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Anhui Xinhua Media maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Anhui Xinhua Media that you should be aware of.

If these risks are making you reconsider your opinion on Anhui Xinhua Media, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.