Vince Holding Corp. (NYSE:VNCE) shareholders would be excited to see that the share price has had a great month, posting a 171% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 56% share price drop in the last twelve months.

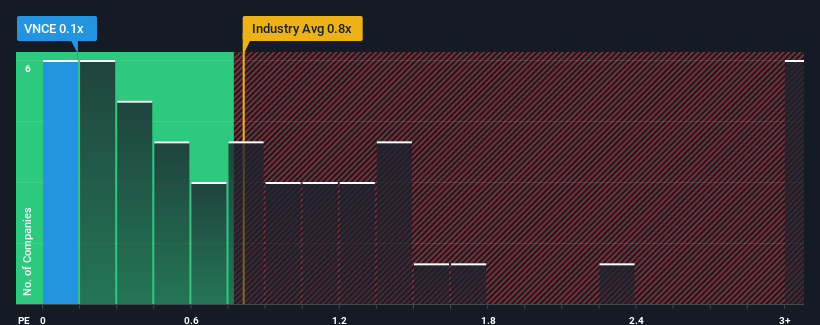

Although its price has surged higher, considering around half the companies operating in the United States' Luxury industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider Vince Holding as an solid investment opportunity with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Vince Holding

NYSE:VNCE Price to Sales Ratio vs Industry December 28th 2023

NYSE:VNCE Price to Sales Ratio vs Industry December 28th 2023

What Does Vince Holding's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Vince Holding over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Vince Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

How Is Vince Holding's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Vince Holding's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 24% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 7.3% shows it's about the same on an annualised basis.

In light of this, it's peculiar that Vince Holding's P/S sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What Does Vince Holding's P/S Mean For Investors?

Vince Holding's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Vince Holding currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

You need to take note of risks, for example - Vince Holding has 4 warning signs (and 2 which are a bit concerning) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.