Jiangxi Special Electric Motor Co.,Ltd (SZSE:002176) shares have continued their recent momentum with a 26% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

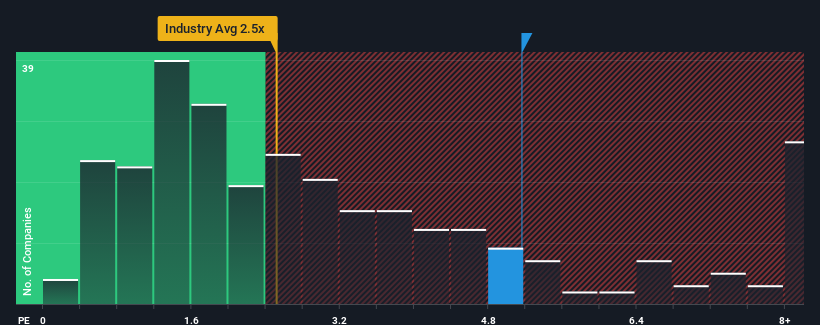

Following the firm bounce in price, you could be forgiven for thinking Jiangxi Special Electric MotorLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.2x, considering almost half the companies in China's Electrical industry have P/S ratios below 2.5x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Jiangxi Special Electric MotorLtd

How Jiangxi Special Electric MotorLtd Has Been Performing

As an illustration, revenue has deteriorated at Jiangxi Special Electric MotorLtd over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jiangxi Special Electric MotorLtd's earnings, revenue and cash flow.How Is Jiangxi Special Electric MotorLtd's Revenue Growth Trending?

Jiangxi Special Electric MotorLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 135% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 31% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Jiangxi Special Electric MotorLtd's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What We Can Learn From Jiangxi Special Electric MotorLtd's P/S?

The strong share price surge has lead to Jiangxi Special Electric MotorLtd's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Jiangxi Special Electric MotorLtd has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Jiangxi Special Electric MotorLtd (at least 1 which shouldn't be ignored), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.