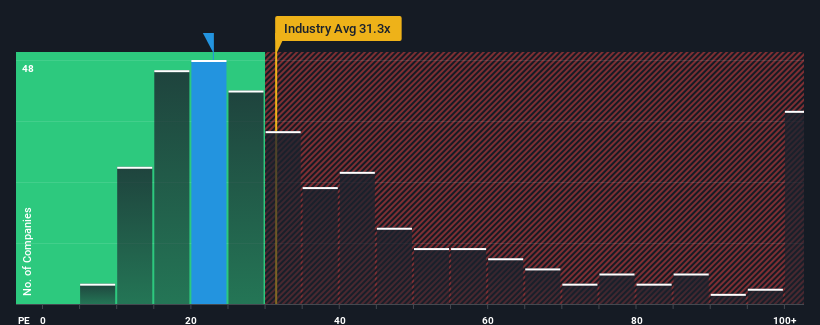

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 35x, you may consider Hefei Meyer Optoelectronic Technology Inc. (SZSE:002690) as an attractive investment with its 22.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Hefei Meyer Optoelectronic Technology has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Hefei Meyer Optoelectronic Technology

Is There Any Growth For Hefei Meyer Optoelectronic Technology?

Hefei Meyer Optoelectronic Technology's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Hefei Meyer Optoelectronic Technology's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 15% last year. The latest three year period has also seen an excellent 57% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 21% as estimated by the ten analysts watching the company. With the market predicted to deliver 44% growth , the company is positioned for a weaker earnings result.

With this information, we can see why Hefei Meyer Optoelectronic Technology is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Hefei Meyer Optoelectronic Technology's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Hefei Meyer Optoelectronic Technology's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 1 warning sign for Hefei Meyer Optoelectronic Technology that we have uncovered.

Of course, you might also be able to find a better stock than Hefei Meyer Optoelectronic Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.