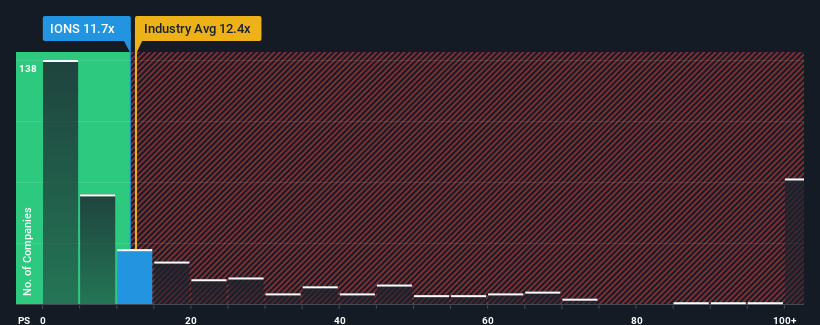

With a median price-to-sales (or "P/S") ratio of close to 12.4x in the Biotechs industry in the United States, you could be forgiven for feeling indifferent about Ionis Pharmaceuticals, Inc.'s (NASDAQ:IONS) P/S ratio of 11.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Ionis Pharmaceuticals

NasdaqGS:IONS Price to Sales Ratio vs Industry December 28th 2023

How Ionis Pharmaceuticals Has Been Performing

While the industry has experienced revenue growth lately, Ionis Pharmaceuticals' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

While the industry has experienced revenue growth lately, Ionis Pharmaceuticals' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Ionis Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.

Is There Some Revenue Growth Forecasted For Ionis Pharmaceuticals?

The only time you'd be comfortable seeing a P/S like Ionis Pharmaceuticals' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's top line. As a result, revenue from three years ago have also fallen 34% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 20% each year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 249% each year growth forecast for the broader industry.

With this information, we find it interesting that Ionis Pharmaceuticals is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Ionis Pharmaceuticals' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Ionis Pharmaceuticals' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Ionis Pharmaceuticals that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.