Wix.com Ltd. (NASDAQ:WIX) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 65% in the last year.

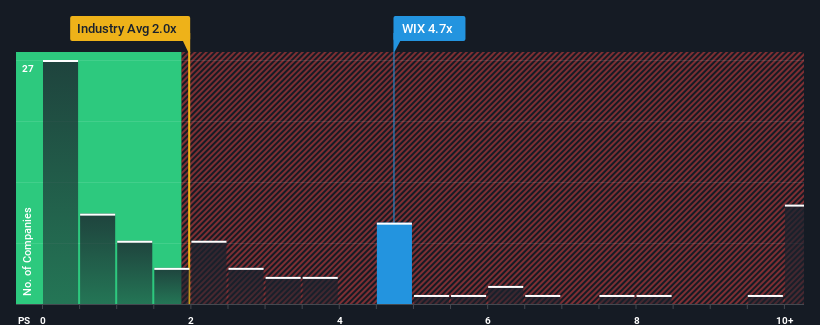

Since its price has surged higher, you could be forgiven for thinking Wix.com is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.7x, considering almost half the companies in the United States' IT industry have P/S ratios below 2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Wix.com

How Wix.com Has Been Performing

Recent times haven't been great for Wix.com as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Recent times haven't been great for Wix.com as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

How Is Wix.com's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Wix.com's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 66% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 11% each year during the coming three years according to the analysts following the company. With the industry predicted to deliver 14% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Wix.com is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Wix.com's P/S?

Shares in Wix.com have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Wix.com, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you take the next step, you should know about the 1 warning sign for Wix.com that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.