Wealthink AI-Innovation Capital Limited (HKG:1140) shareholders are doubtless heartened to see the share price bounce 245% in just one week. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Like a ship taking on water, the share price has sunk 85% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The fundamental business performance will ultimately determine if the turnaround can be sustained. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

On a more encouraging note the company has added HK$2.8b to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

View our latest analysis for Wealthink AI-Innovation Capital

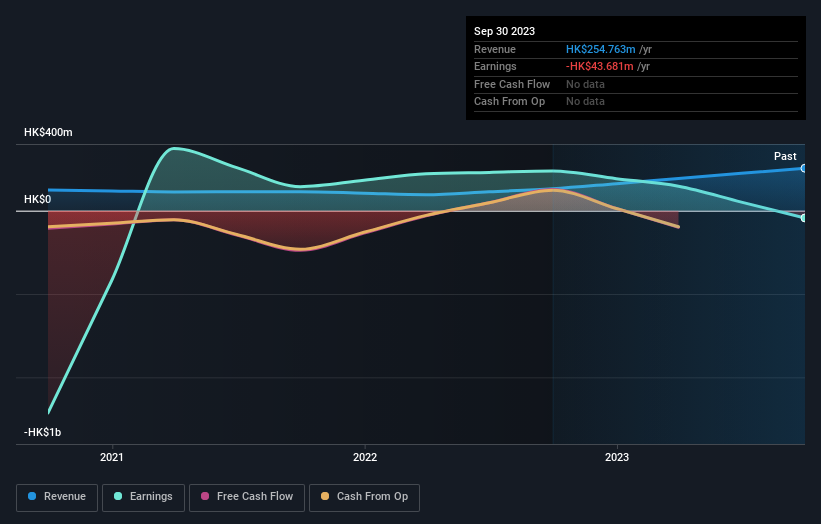

Wealthink AI-Innovation Capital wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Wealthink AI-Innovation Capital wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over half a decade Wealthink AI-Innovation Capital reduced its trailing twelve month revenue by 6.3% for each year. While far from catastrophic that is not good. The share price fall of 13% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. That is not really what the successful investors we know aim for.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Although it hurts that Wealthink AI-Innovation Capital returned a loss of 6.2% in the last twelve months, the broader market was actually worse, returning a loss of 7.4%. Of far more concern is the 13% p.a. loss served to shareholders over the last five years. While the losses are slowing we doubt many shareholders are happy with the stock. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Wealthink AI-Innovation Capital has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.