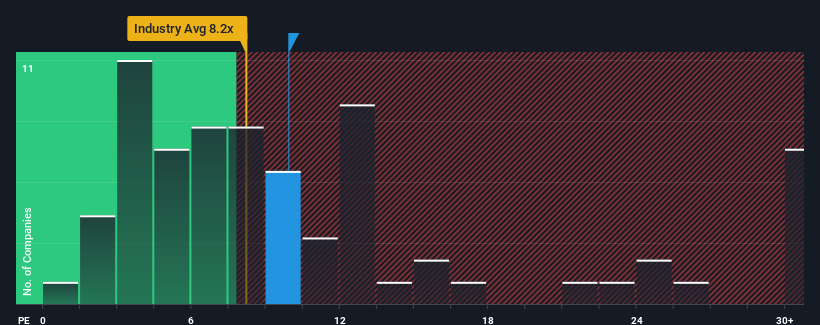

When close to half the companies in the Biotechs industry in China have price-to-sales ratios (or "P/S") below 8.2x, you may consider Shenzhen Kangtai Biological Products Co., Ltd. (SZSE:300601) as a stock to potentially avoid with its 9.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Shenzhen Kangtai Biological Products

How Has Shenzhen Kangtai Biological Products Performed Recently?

While the industry has experienced revenue growth lately, Shenzhen Kangtai Biological Products' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Shenzhen Kangtai Biological Products will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Shenzhen Kangtai Biological Products would need to produce impressive growth in excess of the industry.

In order to justify its P/S ratio, Shenzhen Kangtai Biological Products would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. Even so, admirably revenue has lifted 55% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 50% as estimated by the twelve analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 852%, which is noticeably more attractive.

In light of this, it's alarming that Shenzhen Kangtai Biological Products' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Shenzhen Kangtai Biological Products trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 3 warning signs for Shenzhen Kangtai Biological Products that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.