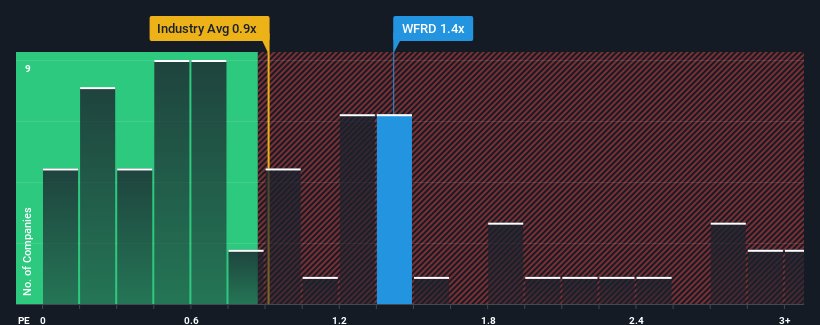

Weatherford International plc's (NASDAQ:WFRD) price-to-sales (or "P/S") ratio of 1.4x may not look like an appealing investment opportunity when you consider close to half the companies in the Energy Services industry in the United States have P/S ratios below 0.9x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Weatherford International

How Weatherford International Has Been Performing

With revenue growth that's inferior to most other companies of late, Weatherford International has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Weatherford International's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Weatherford International?

In order to justify its P/S ratio, Weatherford International would need to produce impressive growth in excess of the industry.

In order to justify its P/S ratio, Weatherford International would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. As a result, it also grew revenue by 22% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 6.4% per year as estimated by the eight analysts watching the company. With the industry predicted to deliver 9.6% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Weatherford International's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Weatherford International's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Weatherford International, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Weatherford International that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.