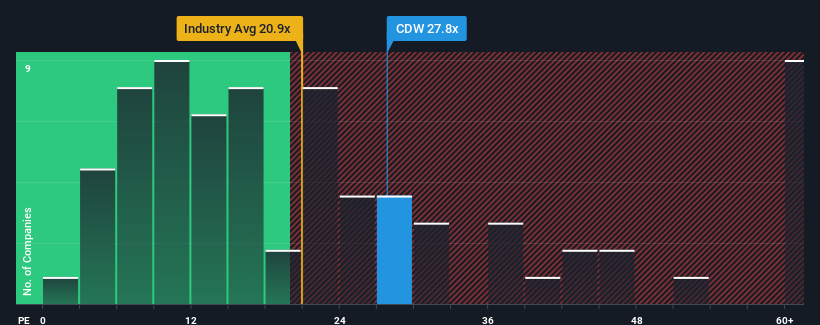

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider CDW Corporation (NASDAQ:CDW) as a stock to avoid entirely with its 27.8x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for CDW as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for CDW

How Is CDW's Growth Trending?

In order to justify its P/E ratio, CDW would need to produce outstanding growth well in excess of the market.

In order to justify its P/E ratio, CDW would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a decent 5.2% gain to the company's bottom line. Pleasingly, EPS has also lifted 59% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 8.6% over the next year. That's shaping up to be similar to the 10% growth forecast for the broader market.

In light of this, it's curious that CDW's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that CDW currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for CDW that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.