- 投資產品

- 交易功能

- 市場分析

- 費用和利率

- 優惠活動

- 資源

- 幫助中心

- 關於我們

- 關於moomoo

- 品牌動態

- Moomoo 桌面端

- Moomoo 基金會

- 紅人計劃

- 投資者關係您即將從moomoo.com跳轉至富途控股官方網站。

- English

- 中文繁體

- 中文简体

- 深色

- 淺色

- 要聞

- 投資者對福建龍工股份有限公司(上海證券交易所股票代碼:600388)持懷疑態度

Investors Holding Back On Fujian Longking Co., Ltd. (SHSE:600388)

Investors Holding Back On Fujian Longking Co., Ltd. (SHSE:600388)

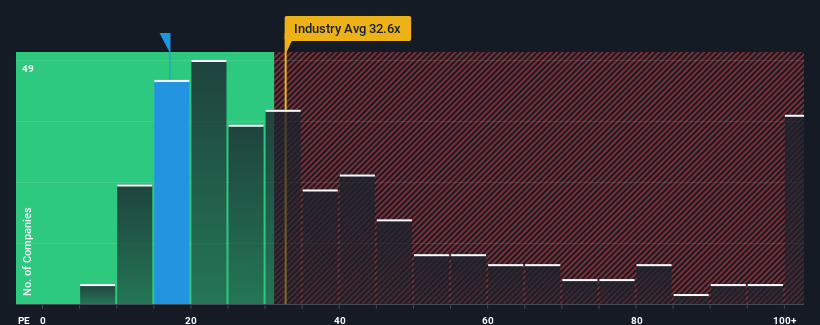

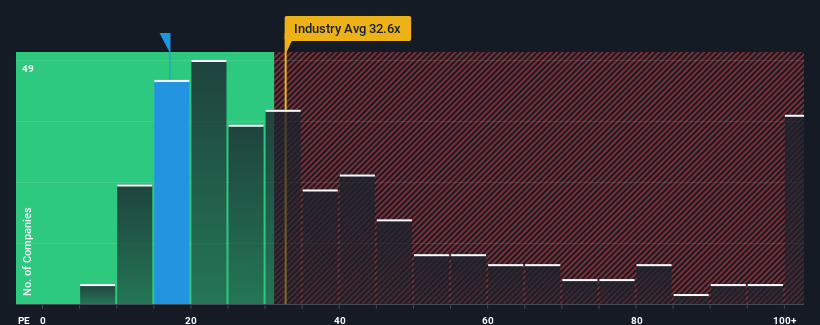

Fujian Longking Co., Ltd.'s (SHSE:600388) price-to-earnings (or "P/E") ratio of 17x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 36x and even P/E's above 65x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Fujian Longking has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Fujian Longking

Is There Any Growth For Fujian Longking?

In order to justify its P/E ratio, Fujian Longking would need to produce anemic growth that's substantially trailing the market.

In order to justify its P/E ratio, Fujian Longking would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings growth, the company posted a worthy increase of 2.6%. However, this wasn't enough as the latest three year period has seen an unpleasant 8.0% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 63% during the coming year according to the three analysts following the company. With the market only predicted to deliver 43%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Fujian Longking's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Fujian Longking's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Fujian Longking currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Fujian Longking that you should be aware of.

If you're unsure about the strength of Fujian Longking's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

福建龍淨股份有限公司's(SHSE: 600388)市盈率(或 “市盈率”)爲17倍,與中國市場相比,目前看上去像是一個強勁的買盤,中國約有一半的公司的市盈率超過36倍,甚至市盈率高於65倍也很常見。但是,市盈率可能很低是有原因的,需要進一步調查以確定其是否合理。

與大多數其他公司的收益下降相比,其收益增長處於正值區間,福建龍淨最近表現良好。一種可能性是市盈率很低,因爲投資者認爲該公司的收益將像其他所有人一樣很快下降。如果不是,那麼現有股東就有理由對股價的未來走向非常樂觀。

查看我們對福建龍王的最新分析

福建龍淨有增長嗎?

爲了證明其市盈率是合理的,福建龍淨需要實現大幅落後於市場的疲軟增長。

爲了證明其市盈率是合理的,福建龍淨需要實現大幅落後於市場的疲軟增長。

如果我們回顧一下去年的收益增長,該公司公佈了2.6%的可觀增長。但是,這還不夠,因爲在最近三年中,每股收益總體下降了8.0%,令人不快。因此,不幸的是,我們必須承認,在此期間,該公司在增加收益方面做得不好。

根據關注該公司的三位分析師的說法,展望未來,預計來年每股收益將增長63%。由於預計市場收益率僅爲43%,該公司有望實現更強勁的盈利業績。

有鑑於此,奇怪的是,福建龍淨的市盈率低於其他大多數公司。顯然,一些股東對預測持懷疑態度,並一直在接受大幅降低的銷售價格。

我們可以從福建龍工的市盈率中學到什麼?

有人認爲,市盈率在某些行業中是衡量價值的次要指標,但它可能是一個有力的商業信心指標。

我們已經確定,福建龍淨目前的市盈率遠低於預期,因爲其預測的增長高於整個市場。當我們看到強勁的盈利前景和快於市場的增長速度時,我們假設潛在風險可能會給市盈率帶來巨大壓力。至少價格風險看起來很低,但投資者似乎認爲未來的收益可能會出現很大的波動。

別忘了可能還有其他風險。例如,我們已經確定了福建龍井的1個警告標誌,你應該注意。

如果您不確定福建龍淨的業務實力,爲什麼不瀏覽我們的互動股票清單,這些股票具有穩健的業務基本面,其中列出了您可能錯過的其他一些公司。

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧