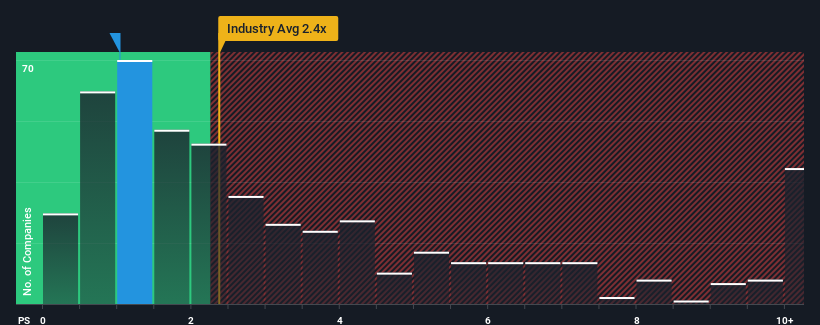

With a price-to-sales (or "P/S") ratio of 1x Jiangsu Baichuan High-Tech New Materials Co., Ltd (SZSE:002455) may be sending bullish signals at the moment, given that almost half of all the Chemicals companies in China have P/S ratios greater than 2.4x and even P/S higher than 6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Jiangsu Baichuan High-Tech New Materials

How Jiangsu Baichuan High-Tech New Materials Has Been Performing

We'd have to say that with no tangible growth over the last year, Jiangsu Baichuan High-Tech New Materials' revenue has been unimpressive. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jiangsu Baichuan High-Tech New Materials will help you shine a light on its historical performance.How Is Jiangsu Baichuan High-Tech New Materials' Revenue Growth Trending?

In order to justify its P/S ratio, Jiangsu Baichuan High-Tech New Materials would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Jiangsu Baichuan High-Tech New Materials would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Although pleasingly revenue has lifted 92% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 29% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Jiangsu Baichuan High-Tech New Materials' P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What We Can Learn From Jiangsu Baichuan High-Tech New Materials' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Jiangsu Baichuan High-Tech New Materials confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Jiangsu Baichuan High-Tech New Materials you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.