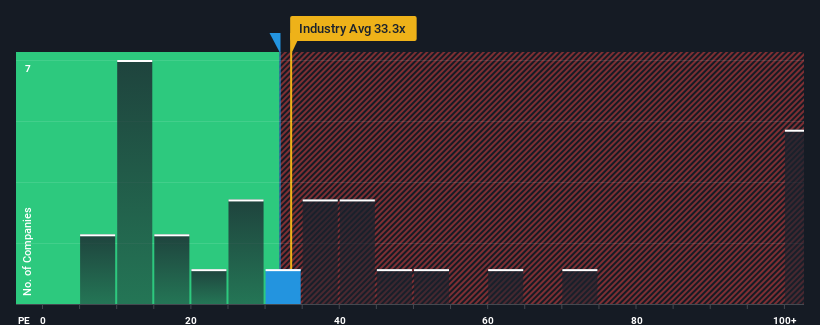

With a median price-to-earnings (or "P/E") ratio of close to 35x in China, you could be forgiven for feeling indifferent about Guangzhou Kingmed Diagnostics Group Co., Ltd.'s (SHSE:603882) P/E ratio of 31.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times haven't been advantageous for Guangzhou Kingmed Diagnostics Group as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Guangzhou Kingmed Diagnostics Group

Does Growth Match The P/E?

In order to justify its P/E ratio, Guangzhou Kingmed Diagnostics Group would need to produce growth that's similar to the market.

In order to justify its P/E ratio, Guangzhou Kingmed Diagnostics Group would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 71%. As a result, earnings from three years ago have also fallen 24% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 27% as estimated by the eleven analysts watching the company. With the market predicted to deliver 43% growth , the company is positioned for a weaker earnings result.

With this information, we find it interesting that Guangzhou Kingmed Diagnostics Group is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Guangzhou Kingmed Diagnostics Group's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Guangzhou Kingmed Diagnostics Group currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Guangzhou Kingmed Diagnostics Group (at least 1 which can't be ignored), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than Guangzhou Kingmed Diagnostics Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.