It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Amalgamated Financial (NASDAQ:AMAL), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Amalgamated Financial

How Quickly Is Amalgamated Financial Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Amalgamated Financial's EPS has grown 28% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Amalgamated Financial's EPS has grown 28% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

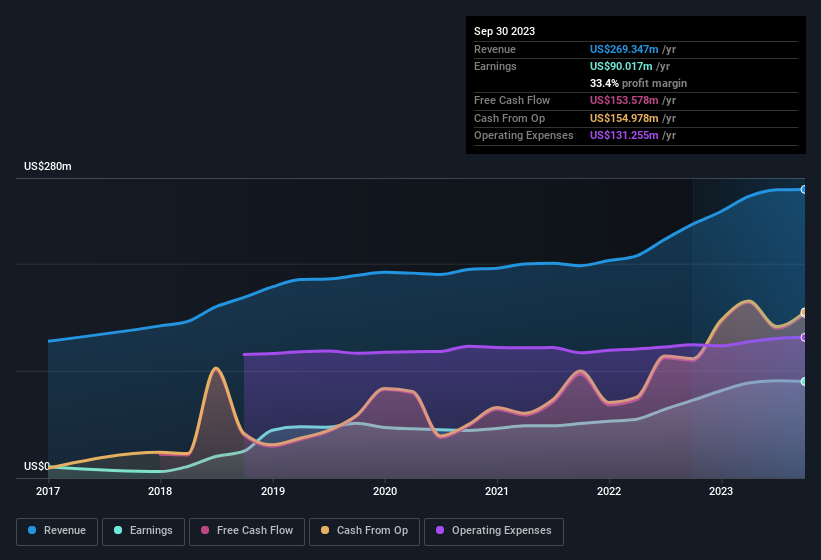

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Amalgamated Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Amalgamated Financial maintained stable EBIT margins over the last year, all while growing revenue 14% to US$269m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Amalgamated Financial's future profits.

Are Amalgamated Financial Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Over the preceding 12 months, we see that company insiders sold US$20k worth of Amalgamated Financial stock. But the silver lining to that cloud is that Maryann Bruce, the Independent Director, spent US$30k buying shares at an average price of US$14.81. So, on balance, that's positive.

Should You Add Amalgamated Financial To Your Watchlist?

You can't deny that Amalgamated Financial has grown its earnings per share at a very impressive rate. That's attractive. The growth rate should be enticing enough to consider researching the company, and the insider buying is a great added bonus. So on this analysis, Amalgamated Financial is probably worth spending some time on. Still, you should learn about the 1 warning sign we've spotted with Amalgamated Financial.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Amalgamated Financial, you'll probably love this curated collection of companies in the US that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.