RoadMainT Co.,Ltd. (SHSE:603860) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. Looking at the bigger picture, even after this poor month the stock is up 29% in the last year.

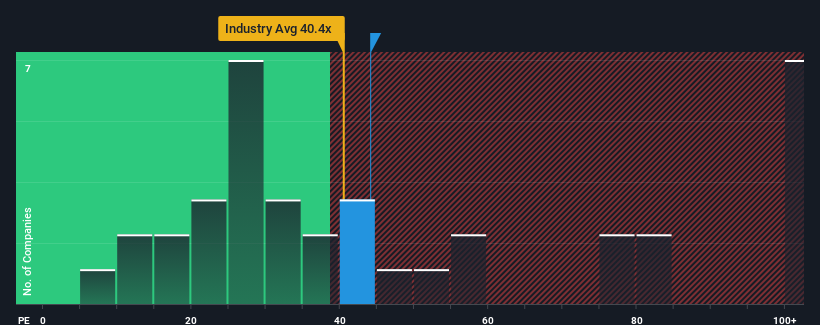

In spite of the heavy fall in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 34x, you may still consider RoadMainTLtd as a stock to potentially avoid with its 44.1x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

RoadMainTLtd has been doing a decent job lately as it's been growing earnings at a reasonable pace. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for RoadMainTLtd

View our latest analysis for RoadMainTLtd

How Is RoadMainTLtd's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like RoadMainTLtd's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 5.3% last year. The latest three year period has also seen an excellent 43% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 43% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that RoadMainTLtd is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Despite the recent share price weakness, RoadMainTLtd's P/E remains higher than most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that RoadMainTLtd currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with RoadMainTLtd (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.