According to data from financial analysis firm S3 Partners, throughout 2023, US stock bears reached nearly $1950 billion in book losses, offsetting about two-thirds of the nearly $300 billion profit they received during the 2022 market crash.

This figure is higher than the cumulative loss of US stock bears in 2021 of about US$142 billion, but lower than the loss of US$242 billion in 2020.

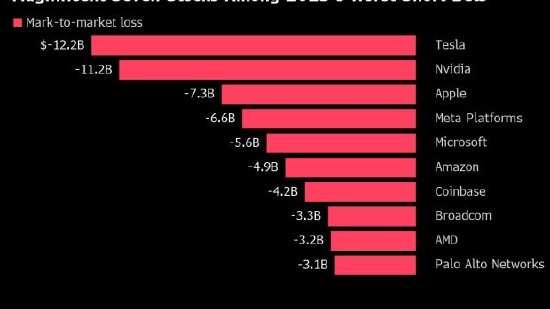

Tesla bears lost the most. The electric car maker's stock price nearly doubled in 2023, causing the bears to lose $12.2 billion on their books.

The top 6 stocks with the biggest losses from the bears all belong to the “Magnificent Seven” (Magnificent Seven).

Nvidia bears ranked second with a loss of 11.2 billion US dollars, Apple bears lost 7.3 billion US dollars, Meta bears lost 6.6 billion US dollars, Microsoft bears lost 5.6 billion US dollars, and Amazon bears lost 4.9 billion US dollars.

As the price of Bitcoin rebounded sharply, Coinbase's stock price soared, causing the bears to lose $4.2 billion last year, ranking 7th.

Ihor Dusaniwsky (Ihor Dusaniwsky), managing director of S3's predictive analysis division, wrote in a report on Thursday that since shorters tend to invest the most of themselves in stocks that rose the most last year, 73% of every dollar they put in generated negative returns.

However, he said that the number of stocks that made shorters profit or lose money last year was more balanced. “Surprisingly, there are almost as many profitable stocks as shorting stocks that don't make money,” Dusanevsky wrote, adding that there were actually more profitable shorted stocks than loss-making shorting stocks among communications services, basic consumer goods, healthcare, materials, and utilities stocks.

Regional banks and vaccine makers were one of the few highlights of shorting in 2023, as stocks in these two sectors experienced their biggest cumulative decline since the worst period of the pandemic last year.

The collapse of First Republic Bank made it the most profitable short bet last year, with book profits of $1.6 billion, according to S3 Partners. Meanwhile, vaccine manufacturer Moderna (shares plummeted 45% last year) came in second place, with bears betting on the stock's decline making $1.1 billion.