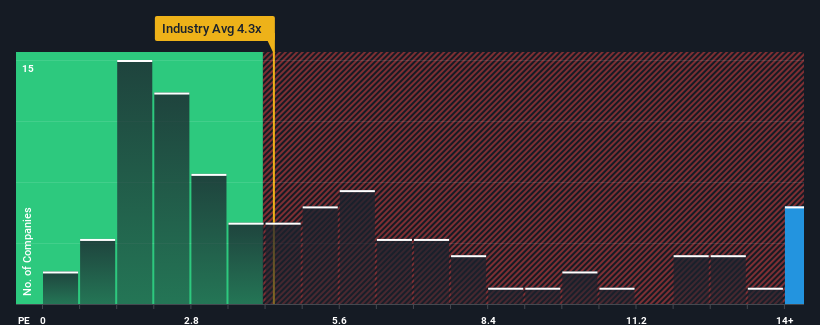

Jiayuan Science and Technology Co.,Ltd.'s (SZSE:301117) price-to-sales (or "P/S") ratio of 15.6x might make it look like a strong sell right now compared to the IT industry in China, where around half of the companies have P/S ratios below 4.3x and even P/S below 2x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Jiayuan Science and TechnologyLtd

How Has Jiayuan Science and TechnologyLtd Performed Recently?

Jiayuan Science and TechnologyLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Jiayuan Science and TechnologyLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jiayuan Science and TechnologyLtd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jiayuan Science and TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 8.6% decrease to the company's top line. Still, the latest three year period has seen an excellent 54% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 96% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 48%, which is noticeably less attractive.

With this information, we can see why Jiayuan Science and TechnologyLtd is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Jiayuan Science and TechnologyLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Jiayuan Science and TechnologyLtd is showing 2 warning signs in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.