ATA Creativity Global (NASDAQ:AACG) shares have had a really impressive month, gaining 37% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 21% over that time.

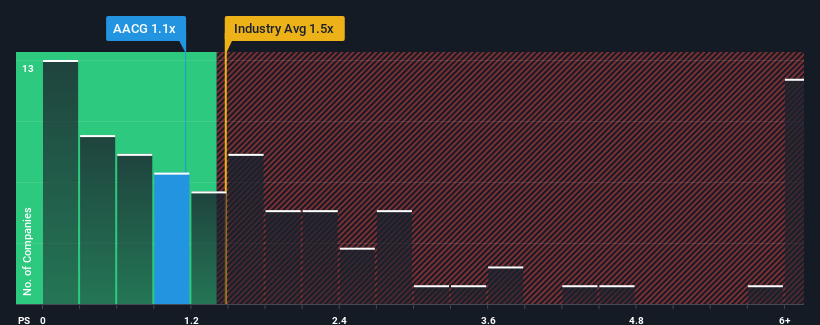

Although its price has surged higher, you could still be forgiven for feeling indifferent about ATA Creativity Global's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Consumer Services industry in the United States is also close to 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for ATA Creativity Global

NasdaqGM:AACG Price to Sales Ratio vs Industry January 7th 2024

NasdaqGM:AACG Price to Sales Ratio vs Industry January 7th 2024

What Does ATA Creativity Global's P/S Mean For Shareholders?

Revenue has risen firmly for ATA Creativity Global recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for ATA Creativity Global, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

How Is ATA Creativity Global's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like ATA Creativity Global's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.8% last year. This was backed up an excellent period prior to see revenue up by 39% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 13% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that ATA Creativity Global's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Key Takeaway

ATA Creativity Global appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears to us that ATA Creativity Global maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for ATA Creativity Global that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

ATAクリエイティビティ・グローバル (NASDAQ:AACG) の株価は、不安定な期間を経て、月間で37%上昇して、非常に印象的な結果となりました。残念なことに、先月の上昇は、株価が21%下落し続けているここ1年間の損失を埋めるのにはほとんど役立ちませんでした。

価格が急上昇しているにもかかわらず、ATAクリエイティビティ・グローバルのP/S比率が1.1倍なのはあなたが無関心に感じることも許されます。なぜなら、アメリカの消費者サービス業界のメディアンの価格-販売比率(または「P/S」比率)も1.5倍に近いからです。これは何の驚きも引き起こさないかもしれませんが、P/S比率が正当化されていない場合、投資家が潜在的な機会を逃す可能性があるか、または迫り来る失望に耳を貸さないことになります。

ATAクリエイティビティ・グローバルの最新分析をチェックしてください。

NasdaqGM:AACGの価格-販売比率と業界の比較(2024年1月7日)

NasdaqGM:AACGの価格-販売比率と業界の比較(2024年1月7日)

ATAクリエイティビティ・グローバルのP/S比率は株主にとって何を意味するのでしょうか?

ATAクリエイティビティ・グローバルの収益は最近しっかりと上昇しており、これを見て嬉しいです。尊敬できる収益性能が低下することを予想している人が多いため、P / Sが上がっていません。それが実現しない場合、既存株主は株価の将来的な方向についてあまり悲観的ではないでしょう。

ATAクリエイティビティ・グローバルのアナリスト予想はありませんが、会社の収益、売上高、現金フローの比較によるデータの豊富な可視化をご覧ください。

ATAクリエイティビティ・グローバルの収益成長はどうなっていますか?

ATAクリエイティビティ・グローバルのP/S比率が同業界に対して合理的であると見なすためには、同業界に匹敵する必要があるという根本的な前提があります。

最初に戻ってみると、会社は昨年に収益を7.8%増やすことに成功しました。これは、前の優れた期間をバックアップしたもので、過去3年間で合計で収益を39%増やしました。したがって、会社はその時間内に収益を拡大するという素晴らしい仕事をしていることを確認できます。

興味深いことに、残りの業界も来年に13%成長することが予想されており、会社の最近の中期平均年間成長率にほぼ等しいです。

このため、ATAクリエイティビティ・グローバルのP/Sはほとんどの他の企業と同じラインにあります。平均的な成長率が将来も続くことを多数の投資家が期待しており、株価に適度な額を支払うことになっているようです。

ATAクリエイティビティ・グローバルは、堅実な価格上昇で再び注目されており、P / Sを他社と同じレベルに戻しています。株を売るべきかどうかを決定する場合、P / S比率だけを使用することは合理的ではありませんが、会社の将来の見通しに実践的なガイドとなり得ます。

ATAクリエイティビティ・グローバルは、過去3年間の成長が業界の見通しと一致していることから、その穏やかなP / Sを維持しているように思われます。現在、過去の収益トレンドが業界の見通しに近いため、株主は会社の将来の収益見通しに大きな驚きが含まれないと信じています。最近の中期的な収益トレンドが続けば、この状況下では株価が大きく動くことは難しいと考えられます。

私たちは優れた企業を探すことが重要であり、最初に出会ったアイデアだけでなく、良い会社を探すことが重要です。したがって、利益性の向上が優れた企業のアイデアに一致する場合は、利益成長が強い興味深い企業の無料リストを確認してください(低P / E)。

ATAクリエイティビティ・グローバルに関する2つの警告事項を考慮する必要があることがわかりました。楽観的な記事にするつもりはありませんが、「Simply Wall St」のコンテンツについてのご意見をお聞かせください。

素晴らしい会社を探すことが重要です。最初に出会ったアイデアだけでなく、この無料の興味深い儲かる企業のリストをチェックしてください(低P / E、儲かる)。

この記事に対するご意見をお聞かせください。コンテンツに問題がある場合は、直接ご連絡ください。代わりに、editorial-team (at) simplywallst.comに電子メールを送信してください。

このSimply Wall Stの記事は一般的な内容です。私たちは、偏りのない方法論を用いた過去のデータやアナリストの予測に基づいて解説を行っていますが、これらの記事は金融アドバイスを提供するものではありません。この記事は、株式の売買をお勧めするものではありません。各自の目的や財務状況に合わせた投資アドバイスは提供されません。私たちは、基本的なデータによって駆動された、長期に渡る重点的な分析を提供することを目的としています。ただし、当社の分析は、最新の価格に敏感な企業の発表や定性的な材料は考慮していない場合があります。Simply Wall Stには、言及されている株式に関するポジションはありません。

NasdaqGM:AACGの価格-販売比率と業界の比較(2024年1月7日)

NasdaqGM:AACGの価格-販売比率と業界の比較(2024年1月7日)

NasdaqGM:AACG Price to Sales Ratio vs Industry January 7th 2024

NasdaqGM:AACG Price to Sales Ratio vs Industry January 7th 2024