Astronics Corporation (NASDAQ:ATRO) Screens Well But There Might Be A Catch

Astronics Corporation (NASDAQ:ATRO) Screens Well But There Might Be A Catch

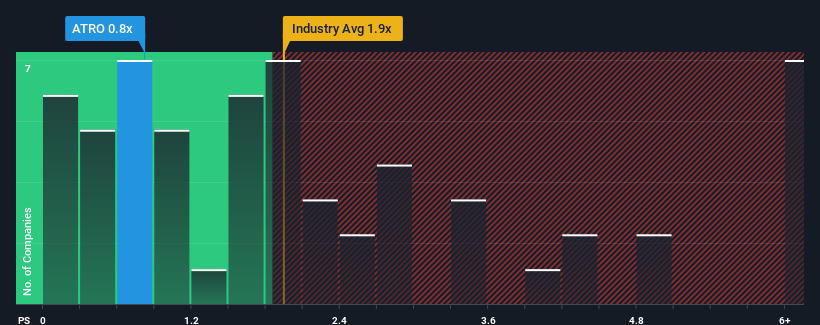

With a price-to-sales (or "P/S") ratio of 0.8x Astronics Corporation (NASDAQ:ATRO) may be sending bullish signals at the moment, given that almost half of all the Aerospace & Defense companies in the United States have P/S ratios greater than 1.9x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

由于市销率(或 “市盈率”)为0.8倍,Astronics Corporation(纳斯达克股票代码:ATRO)目前可能会发出看涨信号,因为美国几乎有一半的航空航天和国防公司的市销率大于1.9倍,甚至市盈率高于4倍的情况并不少见。但是,我们需要更深入地挖掘以确定降低市销率是否有合理的依据。

View our latest analysis for Astronics

查看我们对 Astronics 的最新分析

NasdaqGS:ATRO Price to Sales Ratio vs Industry January 8th 2024

NASDAQGS: ATRO 与行业的股价销售比率 2024 年 1 月 8 日

How Astronics Has Been Performing

Astronics 的表现如何

With revenue growth that's superior to most other companies of late, Astronics has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

由于最近的收入增长优于大多数其他公司,Astronics的表现相对较好。也许市场预计未来的收入表现将下降,这使市销率一直受到抑制。如果公司设法坚持下去,那么投资者应该获得与其收入数字相匹配的股价作为奖励。

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Astronics.

如果你想了解分析师对未来的预测,你应该查看我们关于Astronics的免费报告。

What Are Revenue Growth Metrics Telling Us About The Low P/S?

收入增长指标告诉我们低市销率有哪些?

The only time you'd be truly comfortable seeing a P/S as low as Astronics' is when the company's growth is on track to lag the industry.

只有当公司的增长有望落后于行业时,你才能真正放心地看到像Astronics一样低的市销率。

Taking a look back first, we see that the company grew revenue by an impressive 32% last year. The latest three year period has also seen a 11% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

首先回顾一下,我们发现该公司去年的收入增长了令人印象深刻的32%。在最近三年期间,收入总体增长了11%,这在很大程度上得益于其短期表现。因此,可以公平地说,该公司最近的收入增长是可观的。

Looking ahead now, revenue is anticipated to climb by 13% during the coming year according to the two analysts following the company. With the industry only predicted to deliver 11%, the company is positioned for a stronger revenue result.

关注该公司的两位分析师表示,展望未来,来年收入预计将增长13%。由于预计该行业的收入仅为11%,该公司有望实现更强劲的收入业绩。

With this information, we find it odd that Astronics is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

有了这些信息,我们觉得奇怪的是,Astronics的市销率低于该行业。看来大多数投资者根本不相信公司能够实现未来的增长预期。

The Key Takeaway

关键要点

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

通常,在做出投资决策时,我们会谨慎行事,不要过多地阅读市售比率,尽管这可以充分揭示其他市场参与者对公司的看法。

A look at Astronics' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

看一下Astronics的收入就会发现,尽管未来的增长预测不错,但其市销率远低于我们的预期。可能有一些主要的风险因素给市销率带来下行压力。看来市场可能会预期收入不稳定,因为这些条件通常会提振股价。

It is also worth noting that we have found 2 warning signs for Astronics (1 is concerning!) that you need to take into consideration.

还值得注意的是,我们发现了 2 个 Astronics 的警告信号(1 个令人担忧!)这是你需要考虑的。

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

如果过去盈利增长稳健的公司处于困境,那么你可能希望看到这些盈利增长强劲、市盈率低的其他公司的免费集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接联系我们。或者,也可以发送电子邮件至编辑团队 (at) simplywallst.com。

Simply Wall St 的这篇文章本质上是笼统的。我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章并非旨在提供财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不会考虑最新的价格敏感型公司公告或定性材料。华尔街只是没有持有上述任何股票的头寸。

With revenue growth that's superior to most other companies of late, Astronics has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

With revenue growth that's superior to most other companies of late, Astronics has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.