Qeeka Home (Cayman) Inc. (HKG:1739) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 26% share price drop.

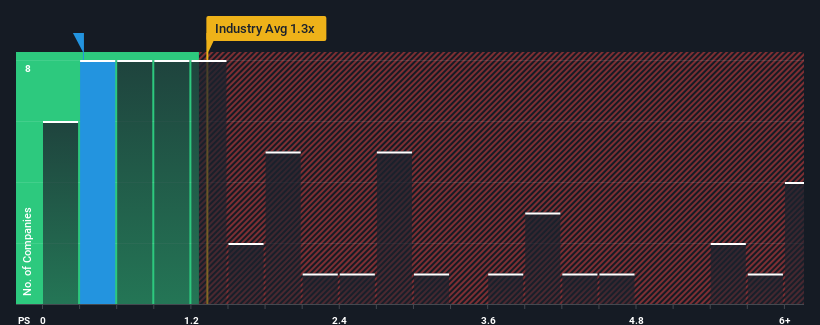

Following the heavy fall in price, it would be understandable if you think Qeeka Home (Cayman) is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in Hong Kong's Consumer Services industry have P/S ratios above 1.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Qeeka Home (Cayman)

What Does Qeeka Home (Cayman)'s P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Qeeka Home (Cayman) over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Qeeka Home (Cayman) will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

As an illustration, revenue has deteriorated at Qeeka Home (Cayman) over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Qeeka Home (Cayman) will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Qeeka Home (Cayman)'s is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.2%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 31% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 18% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Qeeka Home (Cayman) is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Qeeka Home (Cayman)'s P/S

The southerly movements of Qeeka Home (Cayman)'s shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

In line with expectations, Qeeka Home (Cayman) maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Before you settle on your opinion, we've discovered 4 warning signs for Qeeka Home (Cayman) (2 shouldn't be ignored!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.